**Look out for the + Button (at the bottom right of this page) to view more (hidden) parameters**

Part A considerations are "Platform-Generic", meaning that these user-input parameters are 'regular' across all Symbols that are to be traded on the AlgoEdge EA

Part B considerations are also 'regular', but these will be specific and unique (although common in approach) towards the selected trading Symbol chart upon which the EA is to be attached.

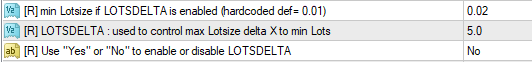

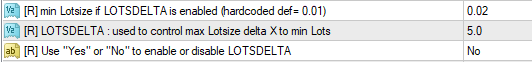

The first Regular 'platform-generic' Parameter that you must make a decision on is actually a group of 3 related parameters and looks like this :

You will find this parameter grouping towards the beginning of the properties table list - simply look for the [R] Prefix and then the associated text:

min Lotsize if LOTSDELTA is enabled (hardcoded def= 0.01)

LOTSDELTA : used to control max Lotsize delta X to min Lotsize

Use "Yes" or "No" to enable or disable LOTSDELTA

(take note of the icon colour - it can help you find the parameter quicker)

This is a Regular selection because your selection here provides guidance to one of the regular CONSISTENCY settings within the AlgoEdge Trading system. Risk management is something that is universally important in trading, but Risk tolerance and appetite is unique to each trader - what this setting provides to you, as the Trader, is the opportunity to 'dial' up/down your own degree of CONSISTENCY preference in the manner in which LOTSIZING is permitted to vary across all the various Symbols that are included in your Portfolio deck.

The way that this parameter works, is that it provides you with the ability to limit the degree of variance between LOTSIZING settings with as low as 1 (which represents no variance at all from LotsMin to LotsMax) and all the way up to any maximum value that you deem to be appropriate. You must enable LOTSDELTA for this parameter group to function. Once 'enabled', the value that you select will manage order or trade entries within this degree of variance across orders/trades.

- for example : If one of your trade entries places an order of 0.02 Lots in a particular symbol and you have selected a LOTSDELTA parameter value of 5 here, then that means that the maximum LOTSIZE order or trade that the system will now place in any other Symbol would be 0.1, i.e. a factor of 5X vs the initial 0.02 Lots traded!

Now, to explain exactly how you will go about enabling and optimising this parameter grouping :

(1) min Lotsize if LOTSDELTA is enabled (hardcoded def= 0.01)

The default for minimum Lotsize is 'hardcoded' at 0.01 Lots - this means that unless you activate LOTSDELTA as explained below then the minimum Lotsize will always be 0.01 (except where the Broker ruling would not allow this for a particular Symbol). You may change this setting to any higher Lotsize that you deem to be appropriate, but this will only activate where you have also enabled LOTSDELTA below.

- to clarify : Lotsizing is determined separately, as described elsewhere in this User Manual and per your respective input preferences. However, if for example, you were to select a value of say 0.25 min Lotsize here and your separate optimisations computed an optimal input of say 0.03, then the minimum Lotsize would actually increase from 0.03 to 0.25, as defined here - this can have very significant impacts on Risk, so be careful of this, especially for higher cost Symbols.

(2) LOTSDELTA : used to control max Lotsize delta X to min Lotsize

The default value for LOTSDELTA is 5 - you may change this to any value that you deem to be appropriate. This parameter selection remains inactive unless you have enabled LOTSDELTA in the manner described below. Once this parameter is enabled, the way it works would be to constrain any Lotsizing that may be computed (based on separate optimisation settings that you would have configured in the section of this User Manual that deals with Lotsizing) for any Symbol across your entire portfolio.

- to clarify : Lotsizing is determined separately, as described elsewhere in this User Manual and per your respective input preferences. However, if for example, you were to select a value of say 2 here for LOTSDELTA, then in that example, even if the optimal Lotsize was computed (based on your separate input settings) to be 1.0 Lots, then the actual trade of 1.0 Lot will not occur, as it will be constrained by the multiple (DELTA) of 2 vs the min Lotsize from the example above of 0.25, meaning that per this example the actual max lotsize placement would be 0.25 X 2 = 0.50 Lots.

(3) Use "Yes" or "No" to enable or disable LOTSDELTA

This parameter selection is self-explanatory and has a default setting of "No" meaning that LOTSDELTA and both of the above associated parameters are INACTIVE by default - if you wish to use this group of parameters, then you must change this setting to "Yes".

Your selection of the most optimal CONSISTENCY setting here will become more evident to you as you progress and build your experience with the AlgoEdge trading system - we have provided this functionality for you for occasions where you may wish to limit the Lotsize variation across Symbols in your portfolio - oddly, there are Prop firms which have this consistency rule, so that may be one occasion where you would find this option to be useful.

Note : in most instances, you may find the default settings for this group of parameters to be adequate/suitable - change them to suit your preferences, and save into your preset file to accept as your own.

You will find this parameter grouping towards the beginning of the properties table list - simply look for the [R] Prefix and then the associated text:

min Lotsize if LOTSDELTA is enabled (hardcoded def= 0.01)

LOTSDELTA : used to control max Lotsize delta X to min Lotsize

Use "Yes" or "No" to enable or disable LOTSDELTA

(take note of the icon colour - it can help you find the parameter quicker)

This is a Regular selection because your selection here provides guidance to one of the regular CONSISTENCY settings within the AlgoEdge Trading system. Risk management is something that is universally important in trading, but Risk tolerance and appetite is unique to each trader - what this setting provides to you, as the Trader, is the opportunity to 'dial' up/down your own degree of CONSISTENCY preference in the manner in which LOTSIZING is permitted to vary across all the various Symbols that are included in your Portfolio deck.

The way that this parameter works, is that it provides you with the ability to limit the degree of variance between LOTSIZING settings with as low as 1 (which represents no variance at all from LotsMin to LotsMax) and all the way up to any maximum value that you deem to be appropriate. You must enable LOTSDELTA for this parameter group to function. Once 'enabled', the value that you select will manage order or trade entries within this degree of variance across orders/trades.

- for example : If one of your trade entries places an order of 0.02 Lots in a particular symbol and you have selected a LOTSDELTA parameter value of 5 here, then that means that the maximum LOTSIZE order or trade that the system will now place in any other Symbol would be 0.1, i.e. a factor of 5X vs the initial 0.02 Lots traded!

Now, to explain exactly how you will go about enabling and optimising this parameter grouping :

(1) min Lotsize if LOTSDELTA is enabled (hardcoded def= 0.01)

The default for minimum Lotsize is 'hardcoded' at 0.01 Lots - this means that unless you activate LOTSDELTA as explained below then the minimum Lotsize will always be 0.01 (except where the Broker ruling would not allow this for a particular Symbol). You may change this setting to any higher Lotsize that you deem to be appropriate, but this will only activate where you have also enabled LOTSDELTA below.

- to clarify : Lotsizing is determined separately, as described elsewhere in this User Manual and per your respective input preferences. However, if for example, you were to select a value of say 0.25 min Lotsize here and your separate optimisations computed an optimal input of say 0.03, then the minimum Lotsize would actually increase from 0.03 to 0.25, as defined here - this can have very significant impacts on Risk, so be careful of this, especially for higher cost Symbols.

(2) LOTSDELTA : used to control max Lotsize delta X to min Lotsize

The default value for LOTSDELTA is 5 - you may change this to any value that you deem to be appropriate. This parameter selection remains inactive unless you have enabled LOTSDELTA in the manner described below. Once this parameter is enabled, the way it works would be to constrain any Lotsizing that may be computed (based on separate optimisation settings that you would have configured in the section of this User Manual that deals with Lotsizing) for any Symbol across your entire portfolio.

- to clarify : Lotsizing is determined separately, as described elsewhere in this User Manual and per your respective input preferences. However, if for example, you were to select a value of say 2 here for LOTSDELTA, then in that example, even if the optimal Lotsize was computed (based on your separate input settings) to be 1.0 Lots, then the actual trade of 1.0 Lot will not occur, as it will be constrained by the multiple (DELTA) of 2 vs the min Lotsize from the example above of 0.25, meaning that per this example the actual max lotsize placement would be 0.25 X 2 = 0.50 Lots.

(3) Use "Yes" or "No" to enable or disable LOTSDELTA

This parameter selection is self-explanatory and has a default setting of "No" meaning that LOTSDELTA and both of the above associated parameters are INACTIVE by default - if you wish to use this group of parameters, then you must change this setting to "Yes".

Your selection of the most optimal CONSISTENCY setting here will become more evident to you as you progress and build your experience with the AlgoEdge trading system - we have provided this functionality for you for occasions where you may wish to limit the Lotsize variation across Symbols in your portfolio - oddly, there are Prop firms which have this consistency rule, so that may be one occasion where you would find this option to be useful.

Note : in most instances, you may find the default settings for this group of parameters to be adequate/suitable - change them to suit your preferences, and save into your preset file to accept as your own.

You will find this parameter grouping towards the beginning of the properties table list - simply look for the [R] Prefix and then the associated text:

min Lotsize if LOTSDELTA is enabled (hardcoded def= 0.01)

LOTSDELTA : used to control max Lotsize delta X to min Lotsize

Use "Yes" or "No" to enable or disable LOTSDELTA

(take note of the icon colour - it can help you find the parameter quicker)

This is a Regular selection because your selection here provides guidance to one of the regular CONSISTENCY settings within the AlgoEdge Trading system. Risk management is something that is universally important in trading, but Risk tolerance and appetite is unique to each trader - what this setting provides to you, as the Trader, is the opportunity to 'dial' up/down your own degree of CONSISTENCY preference in the manner in which LOTSIZING is permitted to vary across all the various Symbols that are included in your Portfolio deck.

The way that this parameter works, is that it provides you with the ability to limit the degree of variance between LOTSIZING settings with as low as 1 (which represents no variance at all from LotsMin to LotsMax) and all the way up to any maximum value that you deem to be appropriate. You must enable LOTSDELTA for this parameter group to function. Once 'enabled', the value that you select will manage order or trade entries within this degree of variance across orders/trades.

- for example : If one of your trade entries places an order of 0.02 Lots in a particular symbol and you have selected a LOTSDELTA parameter value of 5 here, then that means that the maximum LOTSIZE order or trade that the system will now place in any other Symbol would be 0.1, i.e. a factor of 5X vs the initial 0.02 Lots traded!

Now, to explain exactly how you will go about enabling and optimising this parameter grouping :

(1) min Lotsize if LOTSDELTA is enabled (hardcoded def= 0.01)

The default for minimum Lotsize is 'hardcoded' at 0.01 Lots - this means that unless you activate LOTSDELTA as explained below then the minimum Lotsize will always be 0.01 (except where the Broker ruling would not allow this for a particular Symbol). You may change this setting to any higher Lotsize that you deem to be appropriate, but this will only activate where you have also enabled LOTSDELTA below.

- to clarify : Lotsizing is determined separately, as described elsewhere in this User Manual and per your respective input preferences. However, if for example, you were to select a value of say 0.25 min Lotsize here and your separate optimisations computed an optimal input of say 0.03, then the minimum Lotsize would actually increase from 0.03 to 0.25, as defined here - this can have very significant impacts on Risk, so be careful of this, especially for higher cost Symbols.

(2) LOTSDELTA : used to control max Lotsize delta X to min Lotsize

The default value for LOTSDELTA is 5 - you may change this to any value that you deem to be appropriate. This parameter selection remains inactive unless you have enabled LOTSDELTA in the manner described below. Once this parameter is enabled, the way it works would be to constrain any Lotsizing that may be computed (based on separate optimisation settings that you would have configured in the section of this User Manual that deals with Lotsizing) for any Symbol across your entire portfolio.

- to clarify : Lotsizing is determined separately, as described elsewhere in this User Manual and per your respective input preferences. However, if for example, you were to select a value of say 2 here for LOTSDELTA, then in that example, even if the optimal Lotsize was computed (based on your separate input settings) to be 1.0 Lots, then the actual trade of 1.0 Lot will not occur, as it will be constrained by the multiple (DELTA) of 2 vs the min Lotsize from the example above of 0.25, meaning that per this example the actual max lotsize placement would be 0.25 X 2 = 0.50 Lots.

(3) Use "Yes" or "No" to enable or disable LOTSDELTA

This parameter selection is self-explanatory and has a default setting of "No" meaning that LOTSDELTA and both of the above associated parameters are INACTIVE by default - if you wish to use this group of parameters, then you must change this setting to "Yes".

Your selection of the most optimal CONSISTENCY setting here will become more evident to you as you progress and build your experience with the AlgoEdge trading system - we have provided this functionality for you for occasions where you may wish to limit the Lotsize variation across Symbols in your portfolio - oddly, there are Prop firms which have this consistency rule, so that may be one occasion where you would find this option to be useful.

Note : in most instances, you may find the default settings for this group of parameters to be adequate/suitable - change them to suit your preferences, and save into your preset file to accept as your own.

You will find this parameter grouping towards the beginning of the properties table list - simply look for the [R] Prefix and then the associated text:

min Lotsize if LOTSDELTA is enabled (hardcoded def= 0.01)

LOTSDELTA : used to control max Lotsize delta X to min Lotsize

Use "Yes" or "No" to enable or disable LOTSDELTA

(take note of the icon colour - it can help you find the parameter quicker)

This is a Regular selection because your selection here provides guidance to one of the regular CONSISTENCY settings within the AlgoEdge Trading system. Risk management is something that is universally important in trading, but Risk tolerance and appetite is unique to each trader - what this setting provides to you, as the Trader, is the opportunity to 'dial' up/down your own degree of CONSISTENCY preference in the manner in which LOTSIZING is permitted to vary across all the various Symbols that are included in your Portfolio deck.

The way that this parameter works, is that it provides you with the ability to limit the degree of variance between LOTSIZING settings with as low as 1 (which represents no variance at all from LotsMin to LotsMax) and all the way up to any maximum value that you deem to be appropriate. You must enable LOTSDELTA for this parameter group to function. Once 'enabled', the value that you select will manage order or trade entries within this degree of variance across orders/trades.

- for example : If one of your trade entries places an order of 0.02 Lots in a particular symbol and you have selected a LOTSDELTA parameter value of 5 here, then that means that the maximum LOTSIZE order or trade that the system will now place in any other Symbol would be 0.1, i.e. a factor of 5X vs the initial 0.02 Lots traded!

Now, to explain exactly how you will go about enabling and optimising this parameter grouping :

(1) min Lotsize if LOTSDELTA is enabled (hardcoded def= 0.01)

The default for minimum Lotsize is 'hardcoded' at 0.01 Lots - this means that unless you activate LOTSDELTA as explained below then the minimum Lotsize will always be 0.01 (except where the Broker ruling would not allow this for a particular Symbol). You may change this setting to any higher Lotsize that you deem to be appropriate, but this will only activate where you have also enabled LOTSDELTA below.

- to clarify : Lotsizing is determined separately, as described elsewhere in this User Manual and per your respective input preferences. However, if for example, you were to select a value of say 0.25 min Lotsize here and your separate optimisations computed an optimal input of say 0.03, then the minimum Lotsize would actually increase from 0.03 to 0.25, as defined here - this can have very significant impacts on Risk, so be careful of this, especially for higher cost Symbols.

(2) LOTSDELTA : used to control max Lotsize delta X to min Lotsize

The default value for LOTSDELTA is 5 - you may change this to any value that you deem to be appropriate. This parameter selection remains inactive unless you have enabled LOTSDELTA in the manner described below. Once this parameter is enabled, the way it works would be to constrain any Lotsizing that may be computed (based on separate optimisation settings that you would have configured in the section of this User Manual that deals with Lotsizing) for any Symbol across your entire portfolio.

- to clarify : Lotsizing is determined separately, as described elsewhere in this User Manual and per your respective input preferences. However, if for example, you were to select a value of say 2 here for LOTSDELTA, then in that example, even if the optimal Lotsize was computed (based on your separate input settings) to be 1.0 Lots, then the actual trade of 1.0 Lot will not occur, as it will be constrained by the multiple (DELTA) of 2 vs the min Lotsize from the example above of 0.25, meaning that per this example the actual max lotsize placement would be 0.25 X 2 = 0.50 Lots.

(3) Use "Yes" or "No" to enable or disable LOTSDELTA

This parameter selection is self-explanatory and has a default setting of "No" meaning that LOTSDELTA and both of the above associated parameters are INACTIVE by default - if you wish to use this group of parameters, then you must change this setting to "Yes".

Your selection of the most optimal CONSISTENCY setting here will become more evident to you as you progress and build your experience with the AlgoEdge trading system - we have provided this functionality for you for occasions where you may wish to limit the Lotsize variation across Symbols in your portfolio - oddly, there are Prop firms which have this consistency rule, so that may be one occasion where you would find this option to be useful.

Note : in most instances, you may find the default settings for this group of parameters to be adequate/suitable - change them to suit your preferences, and save into your preset file to accept as your own.

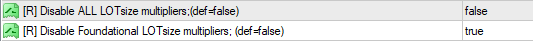

The second Regular 'platform-generic' Parameter that you must make a decision on is actually a pair of related parameters and looks like this :

You will find this parameter pair towards the beginning of the properties table list - simply look for the [R] Prefix and then the associated text:

Disable ALL LOTsize multipliers;(def=false)

Disable Foundational LOTsize multipliers; (def=false)

(take note of the icon colour - it can help you find the parameter quicker)

This is a Regular selection because your selection here provides guidance to the AlgoEdge Trading system on whether or not you wish to apply variable Lotsize multipliers and during which Profit Phases. Risk management is something that is universally important in trading, but Risk tolerance and appetite is unique to each trader - what this setting provides to you, as the Trader, is the opportunity to include/exclude Lotsize multipliers which are optimisation inputs explained elsewhere in this User Manual, but have a universal intent to leverage Profit opportunity, although this may always require periods where a more cautious approach is desirable, hence the opportunity to not activate these parameters.

The way that this parameter pair works, is that it provides you with the ability to limit the degree to which Lotsizing may be increased where certain Profit phases (and some other Lotsizing leverage options) are reached.

The basic premise is that Lotsizing multipliers may be applied to specific Symbol categories, or as your Portfolio expands beyond certain trigger points of Profit, allowing for Profits to be 'locked in' and hence an opportunity to expand margin risk in this more favourable Risk environment.

Now, to explain exactly how you will go about enabling and optimising this parameter grouping :

(1) Disable ALL LOTsize multipliers;(def=false)

By default this parameter function is 'false' meaning that any optimised Lotsizing multipliers are Enabled unless you change this setting. This selection applies to 'ALL' phases, whether in Profit for the Portfolio, or not!

Simply change the setting to 'true' to Disable the application of any Lotsizing multiplier.

NOTE: Disabling Lotsizing multipliers is important in the instance where you may have selected to use LOTSDELTA, as explained elsewhere in this User Manual and to limit minimum and maximum Lotsizing.

(2) Disable Foundational LOTsize multipliers; (def=false)

By default this parameter function is 'false' meaning that any optimised Lotsizing multipliers are Enabled unless you change this setting. This selection applies to only 'Foundational' phases, which refers to the period prior to meeting the trigger requirement for engaging the first portfolio LockProfit for the Portfolio.

Simply change the setting to 'true' to Disable the application of any Lotsizing multiplier.

NOTE: Disabling Lotsizing multipliers is important in the instance where you may have selected to use LOTSDELTA, as explained elsewhere in this User Manual and to limit minimum and maximum Lotsizing.

Your selection of the most optimal use for Lotsizing Multipliers setting here will become more evident to you as you progress and build your experience with the AlgoEdge trading system - we have provided this functionality for you for occasions where you may wish to limit the Lotsize variation across Symbols in your portfolio - oddly, there are Prop firms which have LotSize variation across Symbols as a consistency rule, so that may be one occasion where you would find this option to be useful.

Note : in most instances, you may find the default settings for this group of parameters to be adequate/suitable - change them to suit your preferences, and save into your preset file to accept as your own.

You will find this parameter pair towards the beginning of the properties table list - simply look for the [R] Prefix and then the associated text:

Disable ALL LOTsize multipliers;(def=false)

Disable Foundational LOTsize multipliers; (def=false)

(take note of the icon colour - it can help you find the parameter quicker)

This is a Regular selection because your selection here provides guidance to the AlgoEdge Trading system on whether or not you wish to apply variable Lotsize multipliers and during which Profit Phases. Risk management is something that is universally important in trading, but Risk tolerance and appetite is unique to each trader - what this setting provides to you, as the Trader, is the opportunity to include/exclude Lotsize multipliers which are optimisation inputs explained elsewhere in this User Manual, but have a universal intent to leverage Profit opportunity, although this may always require periods where a more cautious approach is desirable, hence the opportunity to not activate these parameters.

The way that this parameter pair works, is that it provides you with the ability to limit the degree to which Lotsizing may be increased where certain Profit phases (and some other Lotsizing leverage options) are reached.

The basic premise is that Lotsizing multipliers may be applied to specific Symbol categories, or as your Portfolio expands beyond certain trigger points of Profit, allowing for Profits to be 'locked in' and hence an opportunity to expand margin risk in this more favourable Risk environment.

Now, to explain exactly how you will go about enabling and optimising this parameter grouping :

(1) Disable ALL LOTsize multipliers;(def=false)

By default this parameter function is 'false' meaning that any optimised Lotsizing multipliers are Enabled unless you change this setting. This selection applies to 'ALL' phases, whether in Profit for the Portfolio, or not!

Simply change the setting to 'true' to Disable the application of any Lotsizing multiplier.

NOTE: Disabling Lotsizing multipliers is important in the instance where you may have selected to use LOTSDELTA, as explained elsewhere in this User Manual and to limit minimum and maximum Lotsizing.

(2) Disable Foundational LOTsize multipliers; (def=false)

By default this parameter function is 'false' meaning that any optimised Lotsizing multipliers are Enabled unless you change this setting. This selection applies to only 'Foundational' phases, which refers to the period prior to meeting the trigger requirement for engaging the first portfolio LockProfit for the Portfolio.

Simply change the setting to 'true' to Disable the application of any Lotsizing multiplier.

NOTE: Disabling Lotsizing multipliers is important in the instance where you may have selected to use LOTSDELTA, as explained elsewhere in this User Manual and to limit minimum and maximum Lotsizing.

Your selection of the most optimal use for Lotsizing Multipliers setting here will become more evident to you as you progress and build your experience with the AlgoEdge trading system - we have provided this functionality for you for occasions where you may wish to limit the Lotsize variation across Symbols in your portfolio - oddly, there are Prop firms which have LotSize variation across Symbols as a consistency rule, so that may be one occasion where you would find this option to be useful.

Note : in most instances, you may find the default settings for this group of parameters to be adequate/suitable - change them to suit your preferences, and save into your preset file to accept as your own.

The third Regular 'platform-generic' Parameter that you must make a decision on looks like this :

You will find this parameter towards the end of the properties table list - simply look for the [R] Prefix and then the associated text:

Slippage

(take note of the icon colour - it can help you find the parameter quicker)

This is a Regular selection because your selection here provides guidance to the AlgoEdge Trading system on whether or not you wish to adjust the allowable Slippage when your order or trade is placed.

Slippage is a well understood parameter and is not usually a concern factor when dealing with reputable brokers - however, slippage may become an issue in times of high market volatility, or when trading exotic assets.

Now, to explain exactly how you will go about optimising this parameter:

By default this parameter has a value of '100' meaning that your trade order may differ by up to 100 points*, beyond which the order would be ignored/fail.

*NOTE : Brokers work in Points not pips, so slippage is handled as points.

Simply change the setting to any value that you deem to be appropriate.

Simply change the 'slippage' parameter value to suit your preferences, and save into your preset file to accept as your own.

You will find this parameter towards the end of the properties table list - simply look for the [R] Prefix and then the associated text:

Slippage

(take note of the icon colour - it can help you find the parameter quicker)

This is a Regular selection because your selection here provides guidance to the AlgoEdge Trading system on whether or not you wish to adjust the allowable Slippage when your order or trade is placed.

Slippage is a well understood parameter and is not usually a concern factor when dealing with reputable brokers - however, slippage may become an issue in times of high market volatility, or when trading exotic assets.

Now, to explain exactly how you will go about optimising this parameter:

By default this parameter has a value of '100' meaning that your trade order may differ by up to 100 points*, beyond which the order would be ignored/fail.

*NOTE : Brokers work in Points not pips, so slippage is handled as points.

Simply change the setting to any value that you deem to be appropriate.

Simply change the 'slippage' parameter value to suit your preferences, and save into your preset file to accept as your own.

**HIT the + Button (above right) to view more (hidden) parameters**