**Look out for the + Button (at the bottom right of this page) to view more (hidden) parameters**

Part A considerations are "Platform-Generic", meaning that these user-input parameters are 'optional' across all Symbols that are to be traded on the AlgoEdge EA

Part B considerations are also 'optional', but these will be specific and unique (although common in approach) towards the selected trading Symbol chart upon which the EA is to be attached.

The first Optional 'platform-generic' Parameter is an EXTREMELY USEFUL one to know and looks like this:

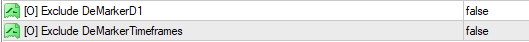

You will find this parameter 3/4 of the way down the properties table list - simply look for the [O] Prefix and then the associated text:

Immediately close entire portfolio!NOW!(Activate=true)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if ever you wish to make a decision to close out all open positions in your portfolio with IMMEDIATE effect - there may be many reasons for this: - perhaps there is a looming News event that you simply want to avoid; perhaps you have hit a Profit level that you just want to close and celebrate the profits; or, perhaps the portfolio is underperforming and you just want 'OUT' even before your pre-defined portfolio loss level engages...

The potential reasons for wanting to engage an immediate portfolio close are many, but this parameter interface simply gives YOU another level of control that has an instant effect!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The way that this parameter works, is very straightforward - All that you need to do is to change the default value of 'false' to 'true' to activate the signal instruction to initiate an immediate 'CloseAll' event across your entire portfolio!

- This is a portfolio-wide action that needs to be activated on only ONE Chart-loaded EA to be effected across the entire portfolio! Simply change the parameter to 'true', select 'OK' at the bottom of the input parameter table and then just 'right-click': Expert Advisors/Properties to re-load the input table and click 'OK' again to be sure that it activates instantly!

NOTE: Once the activation is complete and your portfolio has closed all open positions successfully, you will need to reload the Symbol Chart with the regular 'Master Entry' preset file, otherwise the 'Immediate Close' action will remain in place and new entries into the market will also close immediately ... that would likely cause some frustration, so don't forget this final action.

Naturally, any Symbols where the market is closed at the time of activation of this parameter, will not be able to close until the respective market for that symbol re-opens.

In a situation where you want immediate action across your portfolio, this parameter gives you that urgency in level of control, regardless of the reasons behind your decision

You will find this parameter 3/4 of the way down the properties table list - simply look for the [O] Prefix and then the associated text:

Immediately close entire portfolio!NOW!(Activate=true)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if ever you wish to make a decision to close out all open positions in your portfolio with IMMEDIATE effect - there may be many reasons for this: - perhaps there is a looming News event that you simply want to avoid; perhaps you have hit a Profit level that you just want to close and celebrate the profits; or, perhaps the portfolio is underperforming and you just want 'OUT' even before your pre-defined portfolio loss level engages...

The potential reasons for wanting to engage an immediate portfolio close are many, but this parameter interface simply gives YOU another level of control that has an instant effect!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The way that this parameter works, is very straightforward - All that you need to do is to change the default value of 'false' to 'true' to activate the signal instruction to initiate an immediate 'CloseAll' event across your entire portfolio!

- This is a portfolio-wide action that needs to be activated on only ONE Chart-loaded EA to be effected across the entire portfolio! Simply change the parameter to 'true', select 'OK' at the bottom of the input parameter table and then just 'right-click': Expert Advisors/Properties to re-load the input table and click 'OK' again to be sure that it activates instantly!

NOTE: Once the activation is complete and your portfolio has closed all open positions successfully, you will need to reload the Symbol Chart with the regular 'Master Entry' preset file, otherwise the 'Immediate Close' action will remain in place and new entries into the market will also close immediately ... that would likely cause some frustration, so don't forget this final action.

Naturally, any Symbols where the market is closed at the time of activation of this parameter, will not be able to close until the respective market for that symbol re-opens.

In a situation where you want immediate action across your portfolio, this parameter gives you that urgency in level of control, regardless of the reasons behind your decision

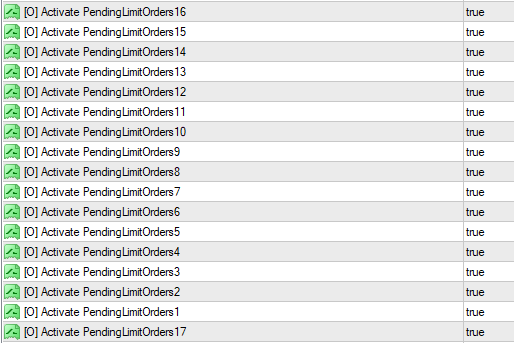

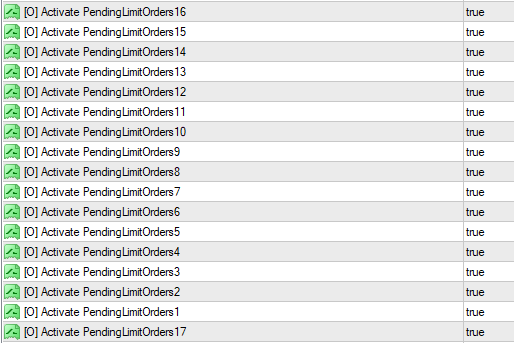

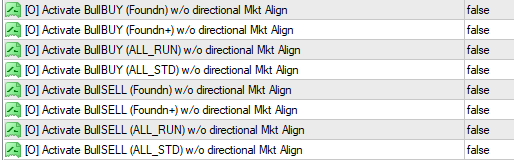

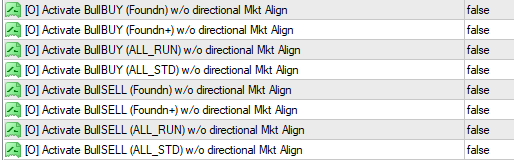

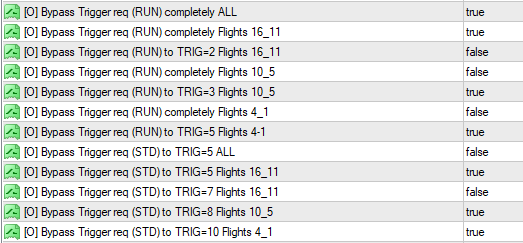

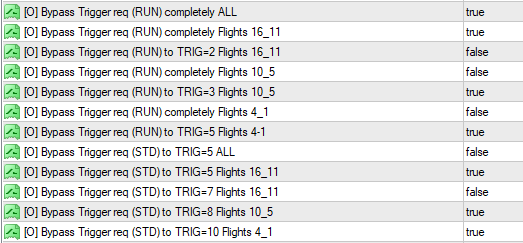

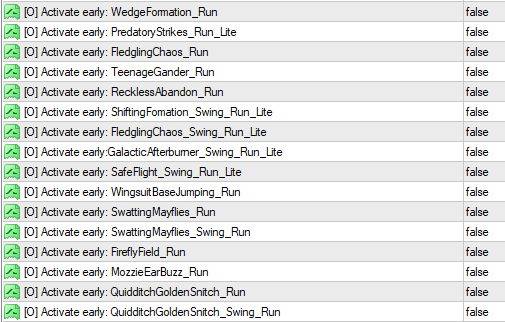

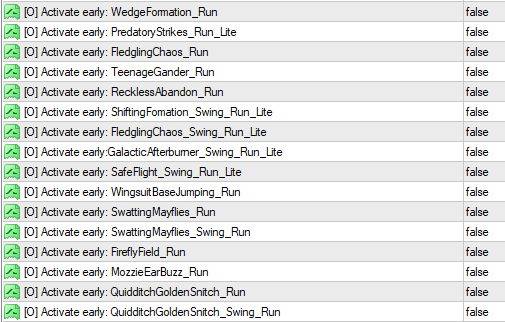

The second Optional 'platform-generic' Parameter is a actually a grouping of parameters that are associated with the activation of pending limit orders across all the AlgoEdge 'Flight Patterns'

- we are giving you autonomy to activate each flight pattern independently, hence the large number of grouped parameters here - this is what the parameter grouping looks like:

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Activate PendingLimitOrders (numbered 1 to 17 to represent each flight pattern)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to directly enter trades at Market, or to rather enter them via Pending Limit order entries. There are advantages to both approaches - if you enter at Market price, then you will never miss a Technical entry from your AlgoEdge EA; whereas if you enter via a Pending Limit Order, then there are times where the order will expire without entry, but an advantage is that you have an opportunity to review and even adjust the Pending Order before it executes the trade.

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter is set to 'true' by default, meaning that all trade entries are via a Pending Limit Order by default, unless you change the parameter setting.

The way that this parameter works, is very straightforward - All that you need to do is to change the default value of 'true' to 'false' to change the instruction to rather send technical orders that are triggered by the AlgoEdge EA directly to the Market - leave the setting as 'true' if you wish to retain the use of Pending Limit Orders.

Also, you may elect to change any one, a mix, or all, of the 17 AlgoEdge Flight Patterns... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the use of 'Pending Limit Orders' for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Activate PendingLimitOrders (numbered 1 to 17 to represent each flight pattern)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to directly enter trades at Market, or to rather enter them via Pending Limit order entries. There are advantages to both approaches - if you enter at Market price, then you will never miss a Technical entry from your AlgoEdge EA; whereas if you enter via a Pending Limit Order, then there are times where the order will expire without entry, but an advantage is that you have an opportunity to review and even adjust the Pending Order before it executes the trade.

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter is set to 'true' by default, meaning that all trade entries are via a Pending Limit Order by default, unless you change the parameter setting.

The way that this parameter works, is very straightforward - All that you need to do is to change the default value of 'true' to 'false' to change the instruction to rather send technical orders that are triggered by the AlgoEdge EA directly to the Market - leave the setting as 'true' if you wish to retain the use of Pending Limit Orders.

Also, you may elect to change any one, a mix, or all, of the 17 AlgoEdge Flight Patterns... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the use of 'Pending Limit Orders' for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Activate PendingLimitOrders (numbered 1 to 17 to represent each flight pattern)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to directly enter trades at Market, or to rather enter them via Pending Limit order entries. There are advantages to both approaches - if you enter at Market price, then you will never miss a Technical entry from your AlgoEdge EA; whereas if you enter via a Pending Limit Order, then there are times where the order will expire without entry, but an advantage is that you have an opportunity to review and even adjust the Pending Order before it executes the trade.

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter is set to 'true' by default, meaning that all trade entries are via a Pending Limit Order by default, unless you change the parameter setting.

The way that this parameter works, is very straightforward - All that you need to do is to change the default value of 'true' to 'false' to change the instruction to rather send technical orders that are triggered by the AlgoEdge EA directly to the Market - leave the setting as 'true' if you wish to retain the use of Pending Limit Orders.

Also, you may elect to change any one, a mix, or all, of the 17 AlgoEdge Flight Patterns... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the use of 'Pending Limit Orders' for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Activate PendingLimitOrders (numbered 1 to 17 to represent each flight pattern)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to directly enter trades at Market, or to rather enter them via Pending Limit order entries. There are advantages to both approaches - if you enter at Market price, then you will never miss a Technical entry from your AlgoEdge EA; whereas if you enter via a Pending Limit Order, then there are times where the order will expire without entry, but an advantage is that you have an opportunity to review and even adjust the Pending Order before it executes the trade.

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter is set to 'true' by default, meaning that all trade entries are via a Pending Limit Order by default, unless you change the parameter setting.

The way that this parameter works, is very straightforward - All that you need to do is to change the default value of 'true' to 'false' to change the instruction to rather send technical orders that are triggered by the AlgoEdge EA directly to the Market - leave the setting as 'true' if you wish to retain the use of Pending Limit Orders.

Also, you may elect to change any one, a mix, or all, of the 17 AlgoEdge Flight Patterns... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the use of 'Pending Limit Orders' for Market entry and then capture and save your preference to the 'Master Entry' preset files.

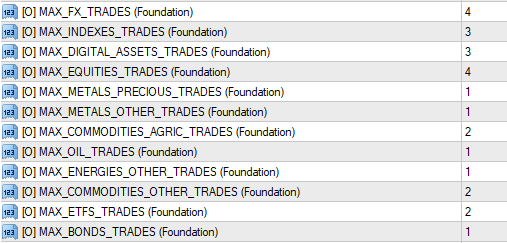

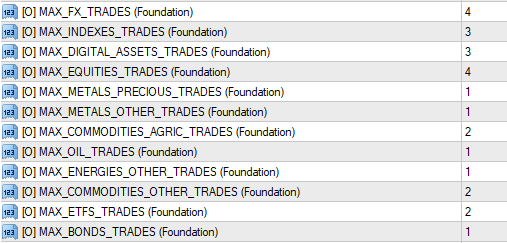

The third Optional 'platform-generic' Parameter is actually a grouping of parameters that are associated with the restriction of the number of open trades that can be placed in the Market across your portfolio and by Category

- we are giving you autonomy to activate each Category 'Max open trade count' restriction independently, hence the large number of grouped parameters here - this is what the parameter grouping looks like:

You will find this parameter grouping 3/4 of the way through the properties table list - simply look for the [O] Prefix and then the associated text:

MAX_FX_TRADES (Foundation)

Note: There is a slight naming convention change applied to represent all Symbol Categories : FX; Indexes; Digital Assets; Equities ; Metals - Precious; Metals - Other; Commodities - Agric; Oil; Energies - Other; Commodities - Other; ETF's; Bonds.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the number of open trades that are allowed, by Symbol Category and as applied during the Foundational Phase of your Portfolio-Build, meaning the period prior to engaging a Portfolio LockProfit. This is important as it actually plays a large role in Risk mitigation at the portfolio level - generally speaking, your Broker will apply different levels of Leverage to each Symbol category, and without having an ability to manage the trade entry count, you may inadvertently favour one category over another - instead, and in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by Symbol category - you may change this to suit your own trading preferences just bear in mind that if you set a parameter for a particular Symbol category as '0' then that will actually eliminate the opportunity for trading that Symbol category throughout your Portfolio-Build - rather set a value of at least '1'. Elsewhere in this User-Manual, we will provide you with an opportunity to separately control a multiplier over these Max limitations - in that application, multipliers are then applied as your Portfolio Profit grows through predefined Trigger and associated LockProfit levels.

NOTE: You may wonder why this limitation is important in a Portfolio grouping that contains just 14 + 3 = 17 Symbols - in this regard, bear in mind that the 99WS AlgoEdge Portfolio-Building Trading system is built to trade across up to 8 of these groupings, all in a synchronised fashion. Therefore, if you have activated all 8 Groupings, the AlgoEdge System would be using these parameter settings in consideration of 8 x 17 = 136 Symbols - in this situation, these parameter settings would take on a very meaningful role in your Portfolio Risk management!

The way that this parameter works, is very straightforward - All that you need to do is to change the default Max Trade count value, by Symbol Category, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the Symbol categories... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Max limitation of open orders in the market (during the Foundational phase) for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping 3/4 of the way through the properties table list - simply look for the [O] Prefix and then the associated text:

MAX_FX_TRADES (Foundation)

Note: There is a slight naming convention change applied to represent all Symbol Categories : FX; Indexes; Digital Assets; Equities ; Metals - Precious; Metals - Other; Commodities - Agric; Oil; Energies - Other; Commodities - Other; ETF's; Bonds.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the number of open trades that are allowed, by Symbol Category and as applied during the Foundational Phase of your Portfolio-Build, meaning the period prior to engaging a Portfolio LockProfit. This is important as it actually plays a large role in Risk mitigation at the portfolio level - generally speaking, your Broker will apply different levels of Leverage to each Symbol category, and without having an ability to manage the trade entry count, you may inadvertently favour one category over another - instead, and in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by Symbol category - you may change this to suit your own trading preferences just bear in mind that if you set a parameter for a particular Symbol category as '0' then that will actually eliminate the opportunity for trading that Symbol category throughout your Portfolio-Build - rather set a value of at least '1'. Elsewhere in this User-Manual, we will provide you with an opportunity to separately control a multiplier over these Max limitations - in that application, multipliers are then applied as your Portfolio Profit grows through predefined Trigger and associated LockProfit levels.

NOTE: You may wonder why this limitation is important in a Portfolio grouping that contains just 14 + 3 = 17 Symbols - in this regard, bear in mind that the 99WS AlgoEdge Portfolio-Building Trading system is built to trade across up to 8 of these groupings, all in a synchronised fashion. Therefore, if you have activated all 8 Groupings, the AlgoEdge System would be using these parameter settings in consideration of 8 x 17 = 136 Symbols - in this situation, these parameter settings would take on a very meaningful role in your Portfolio Risk management!

The way that this parameter works, is very straightforward - All that you need to do is to change the default Max Trade count value, by Symbol Category, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the Symbol categories... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Max limitation of open orders in the market (during the Foundational phase) for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping 3/4 of the way through the properties table list - simply look for the [O] Prefix and then the associated text:

MAX_FX_TRADES (Foundation)

Note: There is a slight naming convention change applied to represent all Symbol Categories : FX; Indexes; Digital Assets; Equities ; Metals - Precious; Metals - Other; Commodities - Agric; Oil; Energies - Other; Commodities - Other; ETF's; Bonds.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the number of open trades that are allowed, by Symbol Category and as applied during the Foundational Phase of your Portfolio-Build, meaning the period prior to engaging a Portfolio LockProfit. This is important as it actually plays a large role in Risk mitigation at the portfolio level - generally speaking, your Broker will apply different levels of Leverage to each Symbol category, and without having an ability to manage the trade entry count, you may inadvertently favour one category over another - instead, and in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by Symbol category - you may change this to suit your own trading preferences just bear in mind that if you set a parameter for a particular Symbol category as '0' then that will actually eliminate the opportunity for trading that Symbol category throughout your Portfolio-Build - rather set a value of at least '1'. Elsewhere in this User-Manual, we will provide you with an opportunity to separately control a multiplier over these Max limitations - in that application, multipliers are then applied as your Portfolio Profit grows through predefined Trigger and associated LockProfit levels.

NOTE: You may wonder why this limitation is important in a Portfolio grouping that contains just 14 + 3 = 17 Symbols - in this regard, bear in mind that the 99WS AlgoEdge Portfolio-Building Trading system is built to trade across up to 8 of these groupings, all in a synchronised fashion. Therefore, if you have activated all 8 Groupings, the AlgoEdge System would be using these parameter settings in consideration of 8 x 17 = 136 Symbols - in this situation, these parameter settings would take on a very meaningful role in your Portfolio Risk management!

The way that this parameter works, is very straightforward - All that you need to do is to change the default Max Trade count value, by Symbol Category, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the Symbol categories... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Max limitation of open orders in the market (during the Foundational phase) for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping 3/4 of the way through the properties table list - simply look for the [O] Prefix and then the associated text:

MAX_FX_TRADES (Foundation)

Note: There is a slight naming convention change applied to represent all Symbol Categories : FX; Indexes; Digital Assets; Equities ; Metals - Precious; Metals - Other; Commodities - Agric; Oil; Energies - Other; Commodities - Other; ETF's; Bonds.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the number of open trades that are allowed, by Symbol Category and as applied during the Foundational Phase of your Portfolio-Build, meaning the period prior to engaging a Portfolio LockProfit. This is important as it actually plays a large role in Risk mitigation at the portfolio level - generally speaking, your Broker will apply different levels of Leverage to each Symbol category, and without having an ability to manage the trade entry count, you may inadvertently favour one category over another - instead, and in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by Symbol category - you may change this to suit your own trading preferences just bear in mind that if you set a parameter for a particular Symbol category as '0' then that will actually eliminate the opportunity for trading that Symbol category throughout your Portfolio-Build - rather set a value of at least '1'. Elsewhere in this User-Manual, we will provide you with an opportunity to separately control a multiplier over these Max limitations - in that application, multipliers are then applied as your Portfolio Profit grows through predefined Trigger and associated LockProfit levels.

NOTE: You may wonder why this limitation is important in a Portfolio grouping that contains just 14 + 3 = 17 Symbols - in this regard, bear in mind that the 99WS AlgoEdge Portfolio-Building Trading system is built to trade across up to 8 of these groupings, all in a synchronised fashion. Therefore, if you have activated all 8 Groupings, the AlgoEdge System would be using these parameter settings in consideration of 8 x 17 = 136 Symbols - in this situation, these parameter settings would take on a very meaningful role in your Portfolio Risk management!

The way that this parameter works, is very straightforward - All that you need to do is to change the default Max Trade count value, by Symbol Category, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the Symbol categories... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Max limitation of open orders in the market (during the Foundational phase) for Market entry and then capture and save your preference to the 'Master Entry' preset files.

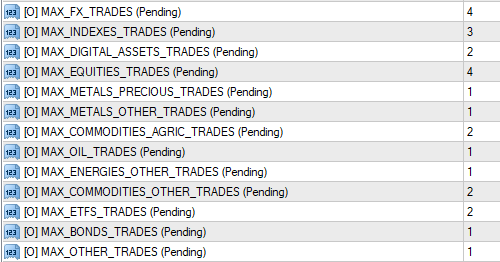

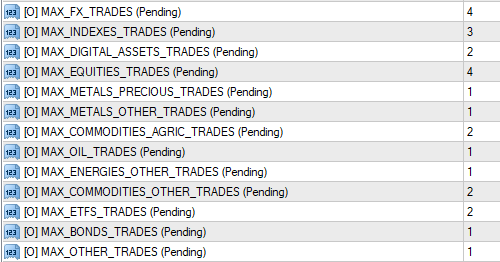

The fourth Optional 'platform-generic' Parameter is actually a grouping of parameters that are associated with the restriction of the number of pending trades that can be placed in the Market across your portfolio and by Category

- we are giving you autonomy to activate each Category 'Max pending order count' restriction independently, hence the large number of grouped parameters here - this is what the parameter grouping looks like:

You will find this parameter grouping 3/4 of the way through the properties table list - simply look for the [O] Prefix and then the associated text:

MAX_FX_TRADES (Pending)

Note: There is a slight naming convention change applied to represent all Symbol Categories : FX; Indexes; Digital Assets; Equities ; Metals - Precious; Metals - Other; Commodities - Agric; Oil; Energies - Other; Commodities - Other; ETF's; Bonds.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the number of open pending orders that are allowed, by Symbol Category

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by Symbol category - you may change this to suit your own trading preferences just bear in mind that pending orders always precede open trades in the market and therefore it is possible that pending open orders reach their maximum limitation prior to open trades doing so. Equally, it is possible that if Open trades reach their Max limitation, there could still be open pending trades that may still execute, even though no more will be placed once the limitation of Max open orders is reached.

NOTE: You may wonder why this limitation is important in a Portfolio grouping that contains just 14 + 3 = 17 Symbols - in this regard, bear in mind that the 99WS AlgoEdge Portfolio-Building Trading system is built to trade across up to 8 of these groupings, all in a synchronised fashion. Therefore, if you have activated all 8 Groupings, the AlgoEdge System would be using these parameter settings in consideration of 8 x 17 = 136 Symbols - in this situation, these parameter settings would take on a very meaningful role in your Portfolio Risk management!

The way that this parameter works, is very straightforward - All that you need to do is to change the default Max Pending Order count value, by Symbol Category, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the Symbol categories... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Max limitation of pending orders for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping 3/4 of the way through the properties table list - simply look for the [O] Prefix and then the associated text:

MAX_FX_TRADES (Pending)

Note: There is a slight naming convention change applied to represent all Symbol Categories : FX; Indexes; Digital Assets; Equities ; Metals - Precious; Metals - Other; Commodities - Agric; Oil; Energies - Other; Commodities - Other; ETF's; Bonds.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the number of open pending orders that are allowed, by Symbol Category

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by Symbol category - you may change this to suit your own trading preferences just bear in mind that pending orders always precede open trades in the market and therefore it is possible that pending open orders reach their maximum limitation prior to open trades doing so. Equally, it is possible that if Open trades reach their Max limitation, there could still be open pending trades that may still execute, even though no more will be placed once the limitation of Max open orders is reached.

NOTE: You may wonder why this limitation is important in a Portfolio grouping that contains just 14 + 3 = 17 Symbols - in this regard, bear in mind that the 99WS AlgoEdge Portfolio-Building Trading system is built to trade across up to 8 of these groupings, all in a synchronised fashion. Therefore, if you have activated all 8 Groupings, the AlgoEdge System would be using these parameter settings in consideration of 8 x 17 = 136 Symbols - in this situation, these parameter settings would take on a very meaningful role in your Portfolio Risk management!

The way that this parameter works, is very straightforward - All that you need to do is to change the default Max Pending Order count value, by Symbol Category, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the Symbol categories... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Max limitation of pending orders for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping 3/4 of the way through the properties table list - simply look for the [O] Prefix and then the associated text:

MAX_FX_TRADES (Pending)

Note: There is a slight naming convention change applied to represent all Symbol Categories : FX; Indexes; Digital Assets; Equities ; Metals - Precious; Metals - Other; Commodities - Agric; Oil; Energies - Other; Commodities - Other; ETF's; Bonds.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the number of open pending orders that are allowed, by Symbol Category

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by Symbol category - you may change this to suit your own trading preferences just bear in mind that pending orders always precede open trades in the market and therefore it is possible that pending open orders reach their maximum limitation prior to open trades doing so. Equally, it is possible that if Open trades reach their Max limitation, there could still be open pending trades that may still execute, even though no more will be placed once the limitation of Max open orders is reached.

NOTE: You may wonder why this limitation is important in a Portfolio grouping that contains just 14 + 3 = 17 Symbols - in this regard, bear in mind that the 99WS AlgoEdge Portfolio-Building Trading system is built to trade across up to 8 of these groupings, all in a synchronised fashion. Therefore, if you have activated all 8 Groupings, the AlgoEdge System would be using these parameter settings in consideration of 8 x 17 = 136 Symbols - in this situation, these parameter settings would take on a very meaningful role in your Portfolio Risk management!

The way that this parameter works, is very straightforward - All that you need to do is to change the default Max Pending Order count value, by Symbol Category, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the Symbol categories... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Max limitation of pending orders for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping 3/4 of the way through the properties table list - simply look for the [O] Prefix and then the associated text:

MAX_FX_TRADES (Pending)

Note: There is a slight naming convention change applied to represent all Symbol Categories : FX; Indexes; Digital Assets; Equities ; Metals - Precious; Metals - Other; Commodities - Agric; Oil; Energies - Other; Commodities - Other; ETF's; Bonds.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the number of open pending orders that are allowed, by Symbol Category

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by Symbol category - you may change this to suit your own trading preferences just bear in mind that pending orders always precede open trades in the market and therefore it is possible that pending open orders reach their maximum limitation prior to open trades doing so. Equally, it is possible that if Open trades reach their Max limitation, there could still be open pending trades that may still execute, even though no more will be placed once the limitation of Max open orders is reached.

NOTE: You may wonder why this limitation is important in a Portfolio grouping that contains just 14 + 3 = 17 Symbols - in this regard, bear in mind that the 99WS AlgoEdge Portfolio-Building Trading system is built to trade across up to 8 of these groupings, all in a synchronised fashion. Therefore, if you have activated all 8 Groupings, the AlgoEdge System would be using these parameter settings in consideration of 8 x 17 = 136 Symbols - in this situation, these parameter settings would take on a very meaningful role in your Portfolio Risk management!

The way that this parameter works, is very straightforward - All that you need to do is to change the default Max Pending Order count value, by Symbol Category, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the Symbol categories... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Max limitation of pending orders for Market entry and then capture and save your preference to the 'Master Entry' preset files.

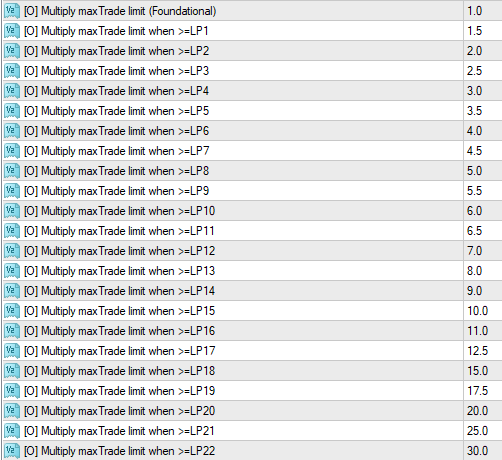

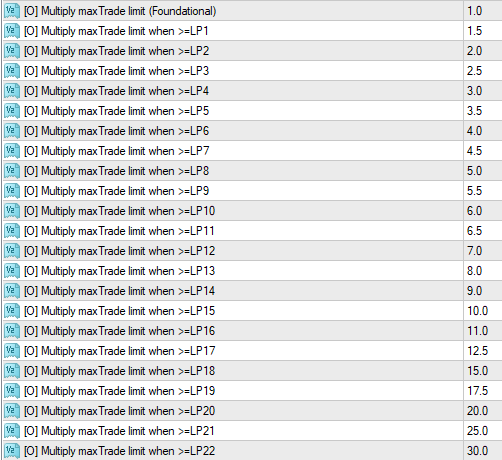

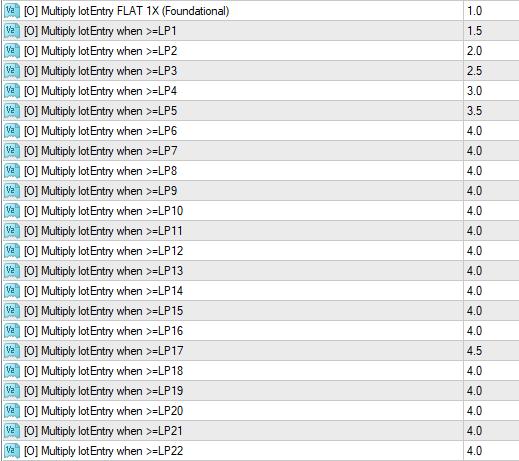

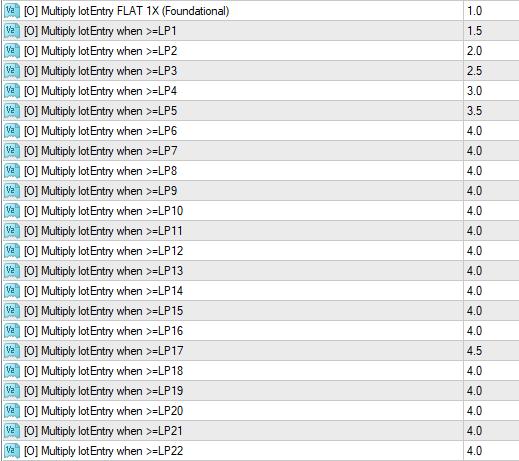

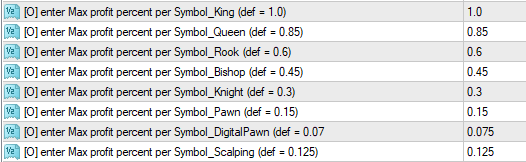

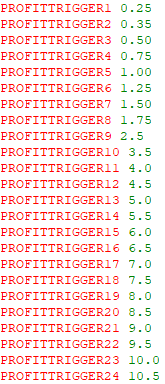

The fifth Optional 'platform-generic' Parameter is actually a grouping of parameters that are associated with the Multiplier that may be applied on Trade counts placed in the Market across your portfolio - the applied Multiplier varies as LockProfit triggers are met aligned to Portfolio Profit growth.

- we are giving you autonomy to define the applied Multiplier from the Foundational Phase through 22 pre-defined LockProfit (LP) phases - this is what the parameter grouping looks like:

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Multiply maxTrade limit

Note: There is a slight naming convention change applied to represent all Lock Profit Phases, starting with the Foundational Phase (prior to any LockProfit engagement, then through LockProfit Phases 1 - 22.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the Multiplier that is applied to the Max Limitation of Open Orders, by LP Phase

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by LockProfit Phase, but begins with a Multiplier of 1.0 during the Foundational Phase - this effectively means that no Multiple is applied to the Max Limitation for Open Trades during the Foundational Phase - you may change this to suit your own trading preferences it is natural to increase this value as LP Phases elevate, to expedite the possible realisation of Profits, although this is never guaranteed and in fact too swift a Multiplier escalation may enhance a CloseAll event on 'pullback' to the LockProfit defined level.

The way that this parameter works, is very straightforward - All that you need to do is to change the default Multiplier value, by LockProfit (LP) Phase, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the LP Phase Multiplier values... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Multiplier Value, by LP Phase, to restrict the Max limitation on total trade count for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Multiply maxTrade limit

Note: There is a slight naming convention change applied to represent all Lock Profit Phases, starting with the Foundational Phase (prior to any LockProfit engagement, then through LockProfit Phases 1 - 22.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the Multiplier that is applied to the Max Limitation of Open Orders, by LP Phase

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by LockProfit Phase, but begins with a Multiplier of 1.0 during the Foundational Phase - this effectively means that no Multiple is applied to the Max Limitation for Open Trades during the Foundational Phase - you may change this to suit your own trading preferences it is natural to increase this value as LP Phases elevate, to expedite the possible realisation of Profits, although this is never guaranteed and in fact too swift a Multiplier escalation may enhance a CloseAll event on 'pullback' to the LockProfit defined level.

The way that this parameter works, is very straightforward - All that you need to do is to change the default Multiplier value, by LockProfit (LP) Phase, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the LP Phase Multiplier values... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Multiplier Value, by LP Phase, to restrict the Max limitation on total trade count for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Multiply maxTrade limit

Note: There is a slight naming convention change applied to represent all Lock Profit Phases, starting with the Foundational Phase (prior to any LockProfit engagement, then through LockProfit Phases 1 - 22.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the Multiplier that is applied to the Max Limitation of Open Orders, by LP Phase

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by LockProfit Phase, but begins with a Multiplier of 1.0 during the Foundational Phase - this effectively means that no Multiple is applied to the Max Limitation for Open Trades during the Foundational Phase - you may change this to suit your own trading preferences it is natural to increase this value as LP Phases elevate, to expedite the possible realisation of Profits, although this is never guaranteed and in fact too swift a Multiplier escalation may enhance a CloseAll event on 'pullback' to the LockProfit defined level.

The way that this parameter works, is very straightforward - All that you need to do is to change the default Multiplier value, by LockProfit (LP) Phase, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the LP Phase Multiplier values... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Multiplier Value, by LP Phase, to restrict the Max limitation on total trade count for Market entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Multiply maxTrade limit

Note: There is a slight naming convention change applied to represent all Lock Profit Phases, starting with the Foundational Phase (prior to any LockProfit engagement, then through LockProfit Phases 1 - 22.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the Multiplier that is applied to the Max Limitation of Open Orders, by LP Phase

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by LockProfit Phase, but begins with a Multiplier of 1.0 during the Foundational Phase - this effectively means that no Multiple is applied to the Max Limitation for Open Trades during the Foundational Phase - you may change this to suit your own trading preferences it is natural to increase this value as LP Phases elevate, to expedite the possible realisation of Profits, although this is never guaranteed and in fact too swift a Multiplier escalation may enhance a CloseAll event on 'pullback' to the LockProfit defined level.

The way that this parameter works, is very straightforward - All that you need to do is to change the default Multiplier value, by LockProfit (LP) Phase, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the LP Phase Multiplier values... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Multiplier Value, by LP Phase, to restrict the Max limitation on total trade count for Market entry and then capture and save your preference to the 'Master Entry' preset files.

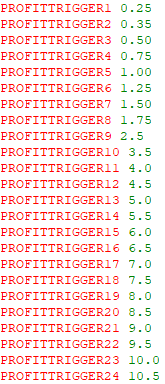

The sixth Optional 'platform-generic' Parameter is actually a grouping of parameters that are associated with the Multiplier that may be applied on Lot Entry Sizing as orders/trades are placed in the Market across your portfolio - the applied Multiplier varies as LockProfit triggers are met aligned to Portfolio Profit growth.

- we are giving you autonomy to define the applied Multiplier from the Foundational Phase through 22 pre-defined LockProfit (LP) phases - this is what the parameter grouping looks like:

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Multiply lotEntry

Note: There is a slight naming convention change applied to represent all Lock Profit Phases, starting with the Foundational Phase (prior to any LockProfit engagement, then through LockProfit Phases 1 - 22.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the Multiplier that is applied to Lot Entry Sizing, by LP Phase

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by LockProfit Phase, but begins with a 'FLAT' Multiplier of 1.0 during the Foundational Phase - this effectively means that no Multiple is applied to the Lot Sizing for new Orders/Trades during the Foundational Phase - you may change this to suit your own trading preferences it is natural to increase this value as LP Phases elevate, to expedite the possible realisation of Profits, although this is never guaranteed and in fact too swift a Multiplier escalation may enhance a CloseAll event on 'pullback' to the LockProfit defined level.

The way that this parameter works, is very straightforward - All that you need to do is to change the default Multiplier value, by LockProfit (LP) Phase, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the LP Phase Multiplier values... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Multiplier Value, by LP Phase, to elevate (Multiply) the Lot Sizing for new Market Order/Trade entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Multiply lotEntry

Note: There is a slight naming convention change applied to represent all Lock Profit Phases, starting with the Foundational Phase (prior to any LockProfit engagement, then through LockProfit Phases 1 - 22.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the Multiplier that is applied to Lot Entry Sizing, by LP Phase

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by LockProfit Phase, but begins with a 'FLAT' Multiplier of 1.0 during the Foundational Phase - this effectively means that no Multiple is applied to the Lot Sizing for new Orders/Trades during the Foundational Phase - you may change this to suit your own trading preferences it is natural to increase this value as LP Phases elevate, to expedite the possible realisation of Profits, although this is never guaranteed and in fact too swift a Multiplier escalation may enhance a CloseAll event on 'pullback' to the LockProfit defined level.

The way that this parameter works, is very straightforward - All that you need to do is to change the default Multiplier value, by LockProfit (LP) Phase, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the LP Phase Multiplier values... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Multiplier Value, by LP Phase, to elevate (Multiply) the Lot Sizing for new Market Order/Trade entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Multiply lotEntry

Note: There is a slight naming convention change applied to represent all Lock Profit Phases, starting with the Foundational Phase (prior to any LockProfit engagement, then through LockProfit Phases 1 - 22.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the Multiplier that is applied to Lot Entry Sizing, by LP Phase

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by LockProfit Phase, but begins with a 'FLAT' Multiplier of 1.0 during the Foundational Phase - this effectively means that no Multiple is applied to the Lot Sizing for new Orders/Trades during the Foundational Phase - you may change this to suit your own trading preferences it is natural to increase this value as LP Phases elevate, to expedite the possible realisation of Profits, although this is never guaranteed and in fact too swift a Multiplier escalation may enhance a CloseAll event on 'pullback' to the LockProfit defined level.

The way that this parameter works, is very straightforward - All that you need to do is to change the default Multiplier value, by LockProfit (LP) Phase, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the LP Phase Multiplier values... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Multiplier Value, by LP Phase, to elevate (Multiply) the Lot Sizing for new Market Order/Trade entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Multiply lotEntry

Note: There is a slight naming convention change applied to represent all Lock Profit Phases, starting with the Foundational Phase (prior to any LockProfit engagement, then through LockProfit Phases 1 - 22.

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because it is entirely up to YOU as the Trader if you wish to change the Multiplier that is applied to Lot Entry Sizing, by LP Phase

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

The parameter default value differs by LockProfit Phase, but begins with a 'FLAT' Multiplier of 1.0 during the Foundational Phase - this effectively means that no Multiple is applied to the Lot Sizing for new Orders/Trades during the Foundational Phase - you may change this to suit your own trading preferences it is natural to increase this value as LP Phases elevate, to expedite the possible realisation of Profits, although this is never guaranteed and in fact too swift a Multiplier escalation may enhance a CloseAll event on 'pullback' to the LockProfit defined level.

The way that this parameter works, is very straightforward - All that you need to do is to change the default Multiplier value, by LockProfit (LP) Phase, to a value that suits your trading style.

Also, you may elect to change any one, a mix, or all, of the LP Phase Multiplier values... the choice is entirely yours!

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Multiplier Value, by LP Phase, to elevate (Multiply) the Lot Sizing for new Market Order/Trade entry and then capture and save your preference to the 'Master Entry' preset files.

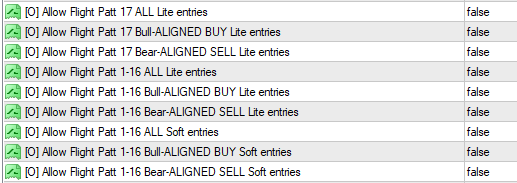

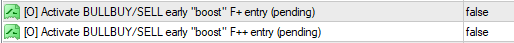

The seventh Optional 'platform-generic' Parameter is actually a grouping of parameters that are associated with the Activation of 'Lite' & 'Soft' Flight Patterns, as well as an ability to differentiate Bull_Alignment vs Bear-Alignment.

- we will explain below what 'Lite' and 'Soft' Patterns are in very generic differentiating terms and you can refer elsewhere in this User Manual for a better understanding of the '16 + 1' Flight Patterns - this is what the parameter grouping looks like:

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Allow Flight Patt 17 ALL Lite entries

Allow Flight Patt 17 Bull-ALIGNED BUY Lite entries

Allow Flight Patt 17 Bear-ALIGNED SELL Lite entries

Allow Flight Patt 1-16 ALL Lite entries

Allow Flight Patt 1-16 Bull-ALIGNED BUY Lite entries

Allow Flight Patt 1-16 Bear-ALIGNED SELL Lite entries

Allow Flight Patt 1-16 ALL Soft entries

Allow Flight Patt 1-16 Bull-ALIGNED BUY Soft entries

Allow Flight Patt 1-16 Bear-ALIGNED SELL Soft entries

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because the activation of these specific Flight Pattern variants are entirely up to YOU as the Trader!

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the Flight Pattern variants that impact order and trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

In all cases, the parameter default setting here is 'false' meaning that none of these Flight Pattern variants are active by default - to activate any of these Flight Pattern variants YOU must change the respective parameter setting to 'true' - simply change this to suit your own trading preferences.

To properly engage with and make a decision on the best parameter setting for you, you need to understand some key aspects that differentiate these Flight Pattern Variants :

(1) 'Lite' Flight Patterns :

Most Flight Patterns have a set of 'Regular' technical* triggers that must be met in order for a trade order to 'fire' - ONE particular technical trigger is used to differentiate 'Lite' from 'Regular' flight pattern variants : The 'regular' flight pattern includes an 'SMA_50' directional monitor - the SMA_50 will always have a timeframe component to it that is unique to each Flight pattern, for example there may be a Flight Pattern that looks at SMA_50 on the 4Hr Timeframe, whereas another flight pattern may consider the SMA_50 on a Weekly timeframe .

With regards to the 'Lite' vs "Regular' differentiation, the timeframe remains unchanged, but for the 'Regular' pattern, we have a '+ve' directional alignment, and for the 'Lite' pattern we have a '-ve' directional alignment - for example: Let's consider a Bullish movement on a Symbol - for the 'Regular' pattern, we would want to see the Market Price ABOVE the respective SMA_50 to secure '+ve' directional alignment ; conversely, for the 'Lite' pattern, we would want to see the Market Price BELOW the respective SMA_50 to secure '-ve' directional alignment. Simple as that!

(2) 'Soft' Flight Patterns :

Most Flight Patterns have a set of 'Regular' technical* triggers that must be met in order for a trade order to 'fire' - ONE particular technical trigger is used to differentiate 'Soft' from 'Regular' flight pattern variants : The 'regular' flight pattern includes an 'SMA_50' directional monitor - the SMA_50 will always have a timeframe component to it that is unique to each Flight pattern, for example there may be a Flight Pattern that looks at SMA_50 on the 4Hr Timeframe, whereas another flight pattern may consider the SMA_50 on a Weekly timeframe .

With regards to the 'Soft' vs "Regular' differentiation, the timeframe remains unchanged, but for the 'Regular' pattern, we have a '+ve' directional alignment, and for the 'Soft' pattern we have NO REQUIREMENT for SMA_50 directional alignment at all - for example: Let's consider a Bullish movement on a Symbol - for the 'Regular' pattern, we would want to see the Market Price ABOVE the respective SMA_50 to secure '+ve' directional alignment ; conversely, for the 'Soft' pattern, there is simply no consideration at all for SMA_50 directional alignment. Simple as that!

(3) 'Bull-Alignment' vs 'Bear-Alignment':

In this parameter grouping, we separate the 17 Flight Patterns into two 'high-level' groups: (a) Flight Pattern '1-16' are all grouped together; (b) Flight Pattern '17' is elected separately from Flight Patterns '1-16'.

For each of these Flight Pattern Groupings, you are able to make 3 separate parameter selections:

(i) Bull-Alignment; (ii) Bear-Alignment; (iii) ALL.

- this is quite self-explanatory, but to be clear : If you only wish to activate Lite/Soft entries for Bullish market moves, then select the respective "Bull-Aligned' parameter to be 'true'; similar if you want to activate only "Bear-Aligned" market moves, then select the respective "Bear-Aligned' parameter to be 'true'; If you do not want to discriminate Bull from Bear market moves, then select the respective "All" parameter to be 'true.

NOTE: *technical triggers that define the 99WS AlgoEdge Flight Patterns are obviously Intellectual Property (IP) and therefore cannot be shared in full detail - however, we do explain these in generic detail elsewhere in this User Manual.

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Lite/Soft entry and then capture and save your preference to the 'Master Entry' preset files.

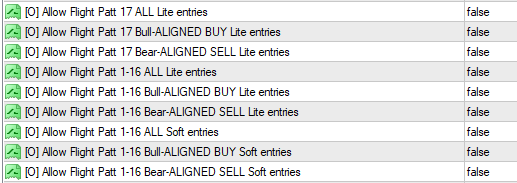

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Allow Flight Patt 17 ALL Lite entries

Allow Flight Patt 17 Bull-ALIGNED BUY Lite entries

Allow Flight Patt 17 Bear-ALIGNED SELL Lite entries

Allow Flight Patt 1-16 ALL Lite entries

Allow Flight Patt 1-16 Bull-ALIGNED BUY Lite entries

Allow Flight Patt 1-16 Bear-ALIGNED SELL Lite entries

Allow Flight Patt 1-16 ALL Soft entries

Allow Flight Patt 1-16 Bull-ALIGNED BUY Soft entries

Allow Flight Patt 1-16 Bear-ALIGNED SELL Soft entries

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because the activation of these specific Flight Pattern variants are entirely up to YOU as the Trader!

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the Flight Pattern variants that impact order and trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

In all cases, the parameter default setting here is 'false' meaning that none of these Flight Pattern variants are active by default - to activate any of these Flight Pattern variants YOU must change the respective parameter setting to 'true' - simply change this to suit your own trading preferences.

To properly engage with and make a decision on the best parameter setting for you, you need to understand some key aspects that differentiate these Flight Pattern Variants :

(1) 'Lite' Flight Patterns :

Most Flight Patterns have a set of 'Regular' technical* triggers that must be met in order for a trade order to 'fire' - ONE particular technical trigger is used to differentiate 'Lite' from 'Regular' flight pattern variants : The 'regular' flight pattern includes an 'SMA_50' directional monitor - the SMA_50 will always have a timeframe component to it that is unique to each Flight pattern, for example there may be a Flight Pattern that looks at SMA_50 on the 4Hr Timeframe, whereas another flight pattern may consider the SMA_50 on a Weekly timeframe .

With regards to the 'Lite' vs "Regular' differentiation, the timeframe remains unchanged, but for the 'Regular' pattern, we have a '+ve' directional alignment, and for the 'Lite' pattern we have a '-ve' directional alignment - for example: Let's consider a Bullish movement on a Symbol - for the 'Regular' pattern, we would want to see the Market Price ABOVE the respective SMA_50 to secure '+ve' directional alignment ; conversely, for the 'Lite' pattern, we would want to see the Market Price BELOW the respective SMA_50 to secure '-ve' directional alignment. Simple as that!

(2) 'Soft' Flight Patterns :

Most Flight Patterns have a set of 'Regular' technical* triggers that must be met in order for a trade order to 'fire' - ONE particular technical trigger is used to differentiate 'Soft' from 'Regular' flight pattern variants : The 'regular' flight pattern includes an 'SMA_50' directional monitor - the SMA_50 will always have a timeframe component to it that is unique to each Flight pattern, for example there may be a Flight Pattern that looks at SMA_50 on the 4Hr Timeframe, whereas another flight pattern may consider the SMA_50 on a Weekly timeframe .

With regards to the 'Soft' vs "Regular' differentiation, the timeframe remains unchanged, but for the 'Regular' pattern, we have a '+ve' directional alignment, and for the 'Soft' pattern we have NO REQUIREMENT for SMA_50 directional alignment at all - for example: Let's consider a Bullish movement on a Symbol - for the 'Regular' pattern, we would want to see the Market Price ABOVE the respective SMA_50 to secure '+ve' directional alignment ; conversely, for the 'Soft' pattern, there is simply no consideration at all for SMA_50 directional alignment. Simple as that!

(3) 'Bull-Alignment' vs 'Bear-Alignment':

In this parameter grouping, we separate the 17 Flight Patterns into two 'high-level' groups: (a) Flight Pattern '1-16' are all grouped together; (b) Flight Pattern '17' is elected separately from Flight Patterns '1-16'.

For each of these Flight Pattern Groupings, you are able to make 3 separate parameter selections:

(i) Bull-Alignment; (ii) Bear-Alignment; (iii) ALL.

- this is quite self-explanatory, but to be clear : If you only wish to activate Lite/Soft entries for Bullish market moves, then select the respective "Bull-Aligned' parameter to be 'true'; similar if you want to activate only "Bear-Aligned" market moves, then select the respective "Bear-Aligned' parameter to be 'true'; If you do not want to discriminate Bull from Bear market moves, then select the respective "All" parameter to be 'true.

NOTE: *technical triggers that define the 99WS AlgoEdge Flight Patterns are obviously Intellectual Property (IP) and therefore cannot be shared in full detail - however, we do explain these in generic detail elsewhere in this User Manual.

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Lite/Soft entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Allow Flight Patt 17 ALL Lite entries

Allow Flight Patt 17 Bull-ALIGNED BUY Lite entries

Allow Flight Patt 17 Bear-ALIGNED SELL Lite entries

Allow Flight Patt 1-16 ALL Lite entries

Allow Flight Patt 1-16 Bull-ALIGNED BUY Lite entries

Allow Flight Patt 1-16 Bear-ALIGNED SELL Lite entries

Allow Flight Patt 1-16 ALL Soft entries

Allow Flight Patt 1-16 Bull-ALIGNED BUY Soft entries

Allow Flight Patt 1-16 Bear-ALIGNED SELL Soft entries

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because the activation of these specific Flight Pattern variants are entirely up to YOU as the Trader!

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the Flight Pattern variants that impact order and trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

In all cases, the parameter default setting here is 'false' meaning that none of these Flight Pattern variants are active by default - to activate any of these Flight Pattern variants YOU must change the respective parameter setting to 'true' - simply change this to suit your own trading preferences.

To properly engage with and make a decision on the best parameter setting for you, you need to understand some key aspects that differentiate these Flight Pattern Variants :

(1) 'Lite' Flight Patterns :

Most Flight Patterns have a set of 'Regular' technical* triggers that must be met in order for a trade order to 'fire' - ONE particular technical trigger is used to differentiate 'Lite' from 'Regular' flight pattern variants : The 'regular' flight pattern includes an 'SMA_50' directional monitor - the SMA_50 will always have a timeframe component to it that is unique to each Flight pattern, for example there may be a Flight Pattern that looks at SMA_50 on the 4Hr Timeframe, whereas another flight pattern may consider the SMA_50 on a Weekly timeframe .

With regards to the 'Lite' vs "Regular' differentiation, the timeframe remains unchanged, but for the 'Regular' pattern, we have a '+ve' directional alignment, and for the 'Lite' pattern we have a '-ve' directional alignment - for example: Let's consider a Bullish movement on a Symbol - for the 'Regular' pattern, we would want to see the Market Price ABOVE the respective SMA_50 to secure '+ve' directional alignment ; conversely, for the 'Lite' pattern, we would want to see the Market Price BELOW the respective SMA_50 to secure '-ve' directional alignment. Simple as that!

(2) 'Soft' Flight Patterns :

Most Flight Patterns have a set of 'Regular' technical* triggers that must be met in order for a trade order to 'fire' - ONE particular technical trigger is used to differentiate 'Soft' from 'Regular' flight pattern variants : The 'regular' flight pattern includes an 'SMA_50' directional monitor - the SMA_50 will always have a timeframe component to it that is unique to each Flight pattern, for example there may be a Flight Pattern that looks at SMA_50 on the 4Hr Timeframe, whereas another flight pattern may consider the SMA_50 on a Weekly timeframe .

With regards to the 'Soft' vs "Regular' differentiation, the timeframe remains unchanged, but for the 'Regular' pattern, we have a '+ve' directional alignment, and for the 'Soft' pattern we have NO REQUIREMENT for SMA_50 directional alignment at all - for example: Let's consider a Bullish movement on a Symbol - for the 'Regular' pattern, we would want to see the Market Price ABOVE the respective SMA_50 to secure '+ve' directional alignment ; conversely, for the 'Soft' pattern, there is simply no consideration at all for SMA_50 directional alignment. Simple as that!

(3) 'Bull-Alignment' vs 'Bear-Alignment':

In this parameter grouping, we separate the 17 Flight Patterns into two 'high-level' groups: (a) Flight Pattern '1-16' are all grouped together; (b) Flight Pattern '17' is elected separately from Flight Patterns '1-16'.

For each of these Flight Pattern Groupings, you are able to make 3 separate parameter selections:

(i) Bull-Alignment; (ii) Bear-Alignment; (iii) ALL.

- this is quite self-explanatory, but to be clear : If you only wish to activate Lite/Soft entries for Bullish market moves, then select the respective "Bull-Aligned' parameter to be 'true'; similar if you want to activate only "Bear-Aligned" market moves, then select the respective "Bear-Aligned' parameter to be 'true'; If you do not want to discriminate Bull from Bear market moves, then select the respective "All" parameter to be 'true.

NOTE: *technical triggers that define the 99WS AlgoEdge Flight Patterns are obviously Intellectual Property (IP) and therefore cannot be shared in full detail - however, we do explain these in generic detail elsewhere in this User Manual.

- This is a portfolio-wide action that needs to be activated and saved to each one of your "Master Entry' preset files.

Simply review and consider the default setting regarding the Lite/Soft entry and then capture and save your preference to the 'Master Entry' preset files.

You will find this parameter grouping towards the end of the properties table list - simply look for the [O] Prefix and then the associated text:

Allow Flight Patt 17 ALL Lite entries

Allow Flight Patt 17 Bull-ALIGNED BUY Lite entries

Allow Flight Patt 17 Bear-ALIGNED SELL Lite entries

Allow Flight Patt 1-16 ALL Lite entries

Allow Flight Patt 1-16 Bull-ALIGNED BUY Lite entries

Allow Flight Patt 1-16 Bear-ALIGNED SELL Lite entries

Allow Flight Patt 1-16 ALL Soft entries

Allow Flight Patt 1-16 Bull-ALIGNED BUY Soft entries

Allow Flight Patt 1-16 Bear-ALIGNED SELL Soft entries

(take note of the icon colour - it can help you find the parameter quicker)

This is an Optional selection because the activation of these specific Flight Pattern variants are entirely up to YOU as the Trader!

- in our normal manner, 99WS AlgoEdge Trading system is providing you with Intellectual Property (IP) that gives you absolute and precise control over the Flight Pattern variants that impact order and trade entries right across your portfolio - you will simply NOT find this anywhere else!

- as always, with the 99WS AlgoEdge Trading system we want to put the power in Your Own Hands!

In all cases, the parameter default setting here is 'false' meaning that none of these Flight Pattern variants are active by default - to activate any of these Flight Pattern variants YOU must change the respective parameter setting to 'true' - simply change this to suit your own trading preferences.

To properly engage with and make a decision on the best parameter setting for you, you need to understand some key aspects that differentiate these Flight Pattern Variants :

(1) 'Lite' Flight Patterns :

Most Flight Patterns have a set of 'Regular' technical* triggers that must be met in order for a trade order to 'fire' - ONE particular technical trigger is used to differentiate 'Lite' from 'Regular' flight pattern variants : The 'regular' flight pattern includes an 'SMA_50' directional monitor - the SMA_50 will always have a timeframe component to it that is unique to each Flight pattern, for example there may be a Flight Pattern that looks at SMA_50 on the 4Hr Timeframe, whereas another flight pattern may consider the SMA_50 on a Weekly timeframe .

With regards to the 'Lite' vs "Regular' differentiation, the timeframe remains unchanged, but for the 'Regular' pattern, we have a '+ve' directional alignment, and for the 'Lite' pattern we have a '-ve' directional alignment - for example: Let's consider a Bullish movement on a Symbol - for the 'Regular' pattern, we would want to see the Market Price ABOVE the respective SMA_50 to secure '+ve' directional alignment ; conversely, for the 'Lite' pattern, we would want to see the Market Price BELOW the respective SMA_50 to secure '-ve' directional alignment. Simple as that!

(2) 'Soft' Flight Patterns :

Most Flight Patterns have a set of 'Regular' technical* triggers that must be met in order for a trade order to 'fire' - ONE particular technical trigger is used to differentiate 'Soft' from 'Regular' flight pattern variants : The 'regular' flight pattern includes an 'SMA_50' directional monitor - the SMA_50 will always have a timeframe component to it that is unique to each Flight pattern, for example there may be a Flight Pattern that looks at SMA_50 on the 4Hr Timeframe, whereas another flight pattern may consider the SMA_50 on a Weekly timeframe .

With regards to the 'Soft' vs "Regular' differentiation, the timeframe remains unchanged, but for the 'Regular' pattern, we have a '+ve' directional alignment, and for the 'Soft' pattern we have NO REQUIREMENT for SMA_50 directional alignment at all - for example: Let's consider a Bullish movement on a Symbol - for the 'Regular' pattern, we would want to see the Market Price ABOVE the respective SMA_50 to secure '+ve' directional alignment ; conversely, for the 'Soft' pattern, there is simply no consideration at all for SMA_50 directional alignment. Simple as that!

(3) 'Bull-Alignment' vs 'Bear-Alignment':

In this parameter grouping, we separate the 17 Flight Patterns into two 'high-level' groups: (a) Flight Pattern '1-16' are all grouped together; (b) Flight Pattern '17' is elected separately from Flight Patterns '1-16'.

For each of these Flight Pattern Groupings, you are able to make 3 separate parameter selections: