**Look out for the + Button (at the bottom right of this page) to view more (hidden) parameters**

Part A considerations are "Platform-Generic", meaning that these user-input parameters are 'important' across all Symbols that are to be traded on the AlgoEdge EA

Part B considerations are also 'important', but these will be specific and unique (although common in approach) towards the selected trading Symbol chart upon which the EA is to be attached.

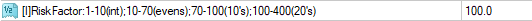

The first Important 'platform-generic' Parameter that you must make a decision on, looks like this :

You will find this parameter towards the beginning of the properties table list - simply look for the [I] Prefix and then the associated text:

RiskFactor:1-10(int);10-70(evens);70-100(10's);100-400(20's)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to one of the primary RISK settings within the AlgoEdge Trading system. Risk management is something that is universally important in trading, but Risk tolerance and appetite is unique to each trader - what this setting provides to you, as the Trader, is the opportunity to 'dial' up/down your own degree of Risk tolerance, as directed towards the overall portfolio trade. The way that this parameter works, is that it provides for a rather broad range of RISK, with guidance from a Risk setting to as low as 1 and all the way up to 400. The value that you select is best understood and handled by the algorithmn when you enter such value as guided in the input text script, meaning: If you would like to use a Risk setting in the range of 1-10, then you should select an integer (round number) within this range; then in the range 10-70, you should select even numbers, i.e. 10/12/14/16......(up to 70); in the range 70-100, your selection should be in intervals of 10, i.e. 70/80/90/100; finally in the range from 100-400, the interval escalation should be in 20 units, i.e. 100/120/140/160...(all the way to 400).

Now, to the understanding of what exactly this Risk setting means and how it is interpreted and provides direction to the Algorithmic behaviour: In very simple terms, the Risk factor is absorbed into a complex evaluation (by the Algo) of leverage, margin availability and degree of portfolio profit/loss - this information is then used to compute an appropriate level of Margin Exposure, which is constantly updated (on every tick in the market) - orders are then placed into the market only up until this 'risk mitigated' MARGINEXPOSURELIMIT is reached.

You are able to view this in action in the text comment section which is overlaid onto the Symbol chart once the AlgoEdge EA has been loaded and activated - below is an example snippet of that commentary line:

You will find this parameter towards the beginning of the properties table list - simply look for the [I] Prefix and then the associated text:

RiskFactor:1-10(int);10-70(evens);70-100(10's);100-400(20's)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to one of the primary RISK settings within the AlgoEdge Trading system. Risk management is something that is universally important in trading, but Risk tolerance and appetite is unique to each trader - what this setting provides to you, as the Trader, is the opportunity to 'dial' up/down your own degree of Risk tolerance, as directed towards the overall portfolio trade. The way that this parameter works, is that it provides for a rather broad range of RISK, with guidance from a Risk setting to as low as 1 and all the way up to 400. The value that you select is best understood and handled by the algorithmn when you enter such value as guided in the input text script, meaning: If you would like to use a Risk setting in the range of 1-10, then you should select an integer (round number) within this range; then in the range 10-70, you should select even numbers, i.e. 10/12/14/16......(up to 70); in the range 70-100, your selection should be in intervals of 10, i.e. 70/80/90/100; finally in the range from 100-400, the interval escalation should be in 20 units, i.e. 100/120/140/160...(all the way to 400).

Now, to the understanding of what exactly this Risk setting means and how it is interpreted and provides direction to the Algorithmic behaviour: In very simple terms, the Risk factor is absorbed into a complex evaluation (by the Algo) of leverage, margin availability and degree of portfolio profit/loss - this information is then used to compute an appropriate level of Margin Exposure, which is constantly updated (on every tick in the market) - orders are then placed into the market only up until this 'risk mitigated' MARGINEXPOSURELIMIT is reached.

You are able to view this in action in the text comment section which is overlaid onto the Symbol chart once the AlgoEdge EA has been loaded and activated - below is an example snippet of that commentary line:

What you will notice from the above example snippet, is that there is a declared Margin Exposure Level that the Algo will work towards, based on this Risk input - the "MARGINEXPOSURELIMIT" shown here actually directly interacts with the MT4 value that is similarly titled as "Margin Level". It is important to understand that as more trades are placed into the market, your portfolio "Margin Level" will drop and when the declared "MARGINEXPOSURELIMIT" is reached, then no further orders (neither pending nor market) will be placed by the EA. Where pending orders have already been placed, then such orders will remain active and may still execute and in such instance, it is possible that the effected "Margin Level" ends up at a lower level than determined by the "MARGINEXPOSURELIMIT" (especially, where such pending order execution into a trade involves a low leveraged Symbol as such symbols naturally use more margin).

It is also important to understand that the "MARGINEXPOSURELIMIT" is dynamic and will respond to portfolio profit/loss levels - in practical terms, if your portfolio moves into Drawdown (DD), then you may notice that the "MARGINEXPOSURELIMIT" is increased, allowing less future orders into the market; similarly, as the portfolio moves into profit, so you may notice the "MARGINEXPOSURELIMIT" reducing, allowing more future orders into the market - this becomes particularly evident, once portfolio profit locks are activated (more on this later).

Your selection of the most optimal Risk setting will become more evident to you as you progress and build your experience with the AlgoEdge trading system - the selected default setting of '100' is reasonably conservative and as such, you may wish to start with this and then dial the setting up/down as you optimise the system to your preference, ideally whilst you are still in the evaluation phase trading with a Demo account (strongly recommended).

Note : this is one of many Risk mitigation measures that have been built into the AlgoEdge Trading system, but it is an important one.

What you will notice from the above example snippet, is that there is a declared Margin Exposure Level that the Algo will work towards, based on this Risk input - the "MARGINEXPOSURELIMIT" shown here actually directly interacts with the MT4 value that is similarly titled as "Margin Level". It is important to understand that as more trades are placed into the market, your portfolio "Margin Level" will drop and when the declared "MARGINEXPOSURELIMIT" is reached, then no further orders (neither pending nor market) will be placed by the EA. Where pending orders have already been placed, then such orders will remain active and may still execute and in such instance, it is possible that the effected "Margin Level" ends up at a lower level than determined by the "MARGINEXPOSURELIMIT" (especially, where such pending order execution into a trade involves a low leveraged Symbol as such symbols naturally use more margin).

It is also important to understand that the "MARGINEXPOSURELIMIT" is dynamic and will respond to portfolio profit/loss levels - in practical terms, if your portfolio moves into Drawdown (DD), then you may notice that the "MARGINEXPOSURELIMIT" is increased, allowing less future orders into the market; similarly, as the portfolio moves into profit, so you may notice the "MARGINEXPOSURELIMIT" reducing, allowing more future orders into the market - this becomes particularly evident, once portfolio profit locks are activated (more on this later).

Your selection of the most optimal Risk setting will become more evident to you as you progress and build your experience with the AlgoEdge trading system - the selected default setting of '100' is reasonably conservative and as such, you may wish to start with this and then dial the setting up/down as you optimise the system to your preference, ideally whilst you are still in the evaluation phase trading with a Demo account (strongly recommended).

Note : this is one of many Risk mitigation measures that have been built into the AlgoEdge Trading system, but it is an important one.

The second Important 'platform-generic' Parameter that you must make a decision on, looks like this :

You will find this parameter towards the end of the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Delay Hours Between Trades

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on how you like to control and space your trades on the same Symbol - this is not a very complex input to understand in that it very simply enforces a minimum delay (in hours) between trade closure events on any specific symbol. The interval/delay that you assign here is not concerned whether the previous trade that you closed was a winning or losing trade, but it simply enforces a time interval before the algorithm is able to reconsider that symbol for a new order or trade entry. Every trader will have their own preference on this, but usually it is considered good guidance by many to take a pause after a trade - if you exited the trade with a win, then it makes little sense to immediately re-enter it as this would imply that you feel you exited too early in the first place; likewise, if you have just exited a trade at a loss, then a swift re-entry can be considered as a kind of 'revenge trade' which is typically 'never a good thing'.

Simply select the trade interval timing (delay) that you think appropriate here and save it to your Master file - the default setting of '8' is basically enforcing that you at least wait until the next major market to open before you trade again - for example : if you closed a trade during the NY session, then an 8 hour delay will make sure that you do not re-enter a position with that same symbol until at least the Asia session.

The choice is always yours - change the Trade Delay setting to suit you!

You will find this parameter towards the end of the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Delay Hours Between Trades

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on how you like to control and space your trades on the same Symbol - this is not a very complex input to understand in that it very simply enforces a minimum delay (in hours) between trade closure events on any specific symbol. The interval/delay that you assign here is not concerned whether the previous trade that you closed was a winning or losing trade, but it simply enforces a time interval before the algorithm is able to reconsider that symbol for a new order or trade entry. Every trader will have their own preference on this, but usually it is considered good guidance by many to take a pause after a trade - if you exited the trade with a win, then it makes little sense to immediately re-enter it as this would imply that you feel you exited too early in the first place; likewise, if you have just exited a trade at a loss, then a swift re-entry can be considered as a kind of 'revenge trade' which is typically 'never a good thing'.

Simply select the trade interval timing (delay) that you think appropriate here and save it to your Master file - the default setting of '8' is basically enforcing that you at least wait until the next major market to open before you trade again - for example : if you closed a trade during the NY session, then an 8 hour delay will make sure that you do not re-enter a position with that same symbol until at least the Asia session.

The choice is always yours - change the Trade Delay setting to suit you!

The third Important 'platform-generic' Parameter that you must make a decision on, looks like this :

You will find this parameter towards the beginning of the properties table list - simply look for the [I] Prefix and then the associated text:

SWING trading = false; Recovery Scalp = true

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on what type of trading style you prefer:

(1) a SWING trading style is typical for a trader who likes to build up a portfolio of trades and may hold positions for a longer time - could be days or even weeks;

(2) A SCALPING trader prefers shorter-term trades that may involve a portfolio, but is more concerned with 'quick market feedback' on your trade - if it is a winning trade then the scalp trader usually wants to exit with a quick profit and if it is a losing trade, then the scalp trader usually wants out of that trade fast and at only a small loss.

Trader techniques and preferences differ tremendously and this is why we have provided this selection opportunity for you.

- at 99WS, we ourselves have a preference for SWING trading and this is the prime basis that underpins the design of the AlgoEdge Trading system which aims to build a profitable portfolio, over time, and then close it when the whole portfolio is (ideally) at a respectable profit.

That said, even as primarily Swing traders, we also at times see the need to deploy what we term here as a "Recovery Scalp" strategy

:- for example, imagine that you have decided to use the AlgoEdge Trading system to pass a Prop Firm challenge and you have gone into a rather desperate Drawdown (DD) - in such a situation, it can be advantageous to engage a number of Risk strategies to prevent falling below that critical 'line in the sand' at which you would fail the challenge - in these situations, we have found a cautious recovery to be quite effective when using this Recovery Scalp setting.

But, this is just one of the ways that we have found this setting to be useful. Ultimately, the decision is up to you how you choose to trade and we are just happy and proud to be able to offer you such diversity in the way that you can choose to configure the AlgoEdge Trading system to suit your own preferences!

The default setting is 'false' which engages a SWING style of strategy; if you prefer to use a Recovery/Scalp strategy, simply change this setting to 'true' and save the setting to your Master Entry 'preset file.

You will find this parameter towards the beginning of the properties table list - simply look for the [I] Prefix and then the associated text:

SWING trading = false; Recovery Scalp = true

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on what type of trading style you prefer:

(1) a SWING trading style is typical for a trader who likes to build up a portfolio of trades and may hold positions for a longer time - could be days or even weeks;

(2) A SCALPING trader prefers shorter-term trades that may involve a portfolio, but is more concerned with 'quick market feedback' on your trade - if it is a winning trade then the scalp trader usually wants to exit with a quick profit and if it is a losing trade, then the scalp trader usually wants out of that trade fast and at only a small loss.

Trader techniques and preferences differ tremendously and this is why we have provided this selection opportunity for you.

- at 99WS, we ourselves have a preference for SWING trading and this is the prime basis that underpins the design of the AlgoEdge Trading system which aims to build a profitable portfolio, over time, and then close it when the whole portfolio is (ideally) at a respectable profit.

That said, even as primarily Swing traders, we also at times see the need to deploy what we term here as a "Recovery Scalp" strategy

:- for example, imagine that you have decided to use the AlgoEdge Trading system to pass a Prop Firm challenge and you have gone into a rather desperate Drawdown (DD) - in such a situation, it can be advantageous to engage a number of Risk strategies to prevent falling below that critical 'line in the sand' at which you would fail the challenge - in these situations, we have found a cautious recovery to be quite effective when using this Recovery Scalp setting.

But, this is just one of the ways that we have found this setting to be useful. Ultimately, the decision is up to you how you choose to trade and we are just happy and proud to be able to offer you such diversity in the way that you can choose to configure the AlgoEdge Trading system to suit your own preferences!

The default setting is 'false' which engages a SWING style of strategy; if you prefer to use a Recovery/Scalp strategy, simply change this setting to 'true' and save the setting to your Master Entry 'preset file.

The fourth Important 'platform-generic' Parameter that you must make a decision on, is again actually a pair of parameters that look like this :

Unfortunately, finding these two parameters is going to frustrate you a little bit in that they are not located together - the first is about 3/4 of the way down the properties input table and the second is further down towards the end of the properties input table - our apologies for that, perhaps we will position them closer together in a future version update...

You will find these parameters by simply scrolling down the properties input table and looking for the [I] Prefix and then the associated text lines:

Emergency Portfolio Percent loss Trigger

Emergency Portfolio loss Trigger(activate@EndDayRollover)

(take note of the icon colour - it can help you find the parameter/s quicker)

This is an Important selection because your selection here very specifically applies:

(a) A portfolio-level percentage (of Account Balance) loss level at which the entire open portfolio will receive a 'Close All positions' trigger;

(b) Provides an opportunity for you to either Activate or De-Activate this 'Close All positions' trigger during the End-of-Day Rollover period; by default, this is set to 'false' meaning that the 'Close All positions' trigger will NOT BE ACTIVE during the daily end-of-day rollover period (unless you change this setting);

It is extremely important that you understand this true/false activation setting and it's potential implications, as well as related alternatives: As an experienced trader already, you will most likely be aware that the End-of-Day Rollover period can sometimes involve a short-period where the spread of financial instruments (Symbols) widen somewhat - this provides opportunity for Brokers to do necessary close-out activities to reset the symbol for the coming trading day; usually, in a short space of time, normal spreads are restored - the issue here is that this momentary change in spread can and will impact the reflected profit/loss position on your portfolio and could therefore cause an 'unnecessary' close out of an entire portfolio position, which can be very frustrating. For this reason, the default is set to 'false' meaning that such portfolio close-outs are avoided by default...but, this does also come with a downside risk: in the rare event that the market is actually in a real dramatic move at the End-of-Day period, then a portfolio-level close could be entirely missed by the system.

We provide two ways around this for you :

(1) You may change the default setting from 'false' to 'true' leaving this protection in place through the daily roll-over period - you need to be aware of the risk stated above that doing so may cause unexpected (and frustrating) portfolio closes at times;

(2) As we will shortly explain in a separate 'Important" parameter descriptive field, we do also provide an 'Immediate close' option, which you can manually use to immediately close the entire portfolio in an event where you experience such an extraordinary event during the Rollover period (bear in mind that relying on this option, will require your presence at your trading station, during the stated Rollover period, which may not be your preference).

Trader techniques and preferences differ tremendously and this is why we have provided this selection opportunity for you.

Please do consider your options on these two parameter settings vey carefully:

(1) Select an appropriate portfolio level percent loss at which you are wanting your portfolio to close to limit further downside loss - the default is set at 1.0%, but this may not be appropriate for your own Trading system and you may rather wish this to be Higher/Lower - you must change the value to suit your own preference and then save this to your master entry preset file;

(1) Make your preferred true/false selection, as described above, to indicate and lock in your own preference for 'End-Day Rollover' periods, in relation to how the AlgoEdge trading system will handle such Loss triggers during these periods.

This is just one more of the multiple Risk mitigation measures that we have designed into the AlgoEdge Trading system!

there are many more...

Unfortunately, finding these two parameters is going to frustrate you a little bit in that they are not located together - the first is about 3/4 of the way down the properties input table and the second is further down towards the end of the properties input table - our apologies for that, perhaps we will position them closer together in a future version update...

You will find these parameters by simply scrolling down the properties input table and looking for the [I] Prefix and then the associated text lines:

Emergency Portfolio Percent loss Trigger

Emergency Portfolio loss Trigger(activate@EndDayRollover)

(take note of the icon colour - it can help you find the parameter/s quicker)

This is an Important selection because your selection here very specifically applies:

(a) A portfolio-level percentage (of Account Balance) loss level at which the entire open portfolio will receive a 'Close All positions' trigger;

(b) Provides an opportunity for you to either Activate or De-Activate this 'Close All positions' trigger during the End-of-Day Rollover period; by default, this is set to 'false' meaning that the 'Close All positions' trigger will NOT BE ACTIVE during the daily end-of-day rollover period (unless you change this setting);

It is extremely important that you understand this true/false activation setting and it's potential implications, as well as related alternatives: As an experienced trader already, you will most likely be aware that the End-of-Day Rollover period can sometimes involve a short-period where the spread of financial instruments (Symbols) widen somewhat - this provides opportunity for Brokers to do necessary close-out activities to reset the symbol for the coming trading day; usually, in a short space of time, normal spreads are restored - the issue here is that this momentary change in spread can and will impact the reflected profit/loss position on your portfolio and could therefore cause an 'unnecessary' close out of an entire portfolio position, which can be very frustrating. For this reason, the default is set to 'false' meaning that such portfolio close-outs are avoided by default...but, this does also come with a downside risk: in the rare event that the market is actually in a real dramatic move at the End-of-Day period, then a portfolio-level close could be entirely missed by the system.

We provide two ways around this for you :

(1) You may change the default setting from 'false' to 'true' leaving this protection in place through the daily roll-over period - you need to be aware of the risk stated above that doing so may cause unexpected (and frustrating) portfolio closes at times;

(2) As we will shortly explain in a separate 'Important" parameter descriptive field, we do also provide an 'Immediate close' option, which you can manually use to immediately close the entire portfolio in an event where you experience such an extraordinary event during the Rollover period (bear in mind that relying on this option, will require your presence at your trading station, during the stated Rollover period, which may not be your preference).

Trader techniques and preferences differ tremendously and this is why we have provided this selection opportunity for you.

Please do consider your options on these two parameter settings vey carefully:

(1) Select an appropriate portfolio level percent loss at which you are wanting your portfolio to close to limit further downside loss - the default is set at 1.0%, but this may not be appropriate for your own Trading system and you may rather wish this to be Higher/Lower - you must change the value to suit your own preference and then save this to your master entry preset file;

(1) Make your preferred true/false selection, as described above, to indicate and lock in your own preference for 'End-Day Rollover' periods, in relation to how the AlgoEdge trading system will handle such Loss triggers during these periods.

This is just one more of the multiple Risk mitigation measures that we have designed into the AlgoEdge Trading system!

there are many more...

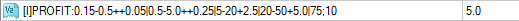

The fifth Important 'platform-generic' Parameter that you must make a decision on, looks like this :

You will find this parameter right towards the beginning of the properties table list - simply look for the [I] Prefix and then the associated text:

PROFIT:0.15-0.5++0.05|0.5-5.0++0.25|5-20+2.5|20-50+5.0|75;100

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on your portfolio profit objectives for the position that you are building - you need to be aware though : this is NOT the only manner in which profit is taken at the portfolio level and in fact, as we will explain elsewhere, the AlgoEdge system also uses a portfolio-level trailing 'LockProfit' mechanism which is unique IP that we have developed for our traders benefit and is more likely to engage a portfolio-level profit close than this particular Profit objective, although this does to quite a large extent depend on your selection made at this point.

Let's explain that further:-

if for example, you were to select a fairly low profit target here, say 0.5%, then that profit target would be very active and would be likely to fire way before any consideration of a trailing LockProfit level; in another example, if you were to leave the default setting of 5.0% in place, then that is a very large portfolio-level profit objective and it would therefore be perhaps more likely that the LockProfit trail would be the one to fire a CloseAll event first.

Simply select the portfolio-level % Profit objective that you think appropriate here and save it to your Master file - the default setting of '5.0' represents 5.0% profit at the portfolio-level. The value that you select is best understood and handled by the algorithm when you enter such value as guided in the input text script, meaning: If you would like to use a Profit setting in the range of 0.15-0.5%, then your selected increments should be 0.05%, i.e. 0.05/0.10/0.15; then in the range 0.5-5.0%, your selected increments should be 0.25%, i.e. 0.50/0.75/1.0/1.25...(up to 5.0); in the range 5.0-20, your selection should be in intervals of 2.5%, i.e. 5.0/7.5/10.0/12.5...(up to 20);in the range 20-50, your selection should be in intervals of 5%, i.e. 20/25/30/35...(up to 50); finally your jump to 100 would then be selected in 2 steps : 75/100%. so, we have provided an ability for you to select a Profit objective all the way to 100% - to be honest, this is an insane (celebrations needed) objective and would need some very significant 'wind in your sails' to ever achieve - of course, anything is possible, so please do drop us a note if you ever hit such amazing returns using the AlgoEdge trading system!

The choice is always yours - change the Profit setting to suit you!

You will find this parameter right towards the beginning of the properties table list - simply look for the [I] Prefix and then the associated text:

PROFIT:0.15-0.5++0.05|0.5-5.0++0.25|5-20+2.5|20-50+5.0|75;100

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on your portfolio profit objectives for the position that you are building - you need to be aware though : this is NOT the only manner in which profit is taken at the portfolio level and in fact, as we will explain elsewhere, the AlgoEdge system also uses a portfolio-level trailing 'LockProfit' mechanism which is unique IP that we have developed for our traders benefit and is more likely to engage a portfolio-level profit close than this particular Profit objective, although this does to quite a large extent depend on your selection made at this point.

Let's explain that further:-

if for example, you were to select a fairly low profit target here, say 0.5%, then that profit target would be very active and would be likely to fire way before any consideration of a trailing LockProfit level; in another example, if you were to leave the default setting of 5.0% in place, then that is a very large portfolio-level profit objective and it would therefore be perhaps more likely that the LockProfit trail would be the one to fire a CloseAll event first.

Simply select the portfolio-level % Profit objective that you think appropriate here and save it to your Master file - the default setting of '5.0' represents 5.0% profit at the portfolio-level. The value that you select is best understood and handled by the algorithm when you enter such value as guided in the input text script, meaning: If you would like to use a Profit setting in the range of 0.15-0.5%, then your selected increments should be 0.05%, i.e. 0.05/0.10/0.15; then in the range 0.5-5.0%, your selected increments should be 0.25%, i.e. 0.50/0.75/1.0/1.25...(up to 5.0); in the range 5.0-20, your selection should be in intervals of 2.5%, i.e. 5.0/7.5/10.0/12.5...(up to 20);in the range 20-50, your selection should be in intervals of 5%, i.e. 20/25/30/35...(up to 50); finally your jump to 100 would then be selected in 2 steps : 75/100%. so, we have provided an ability for you to select a Profit objective all the way to 100% - to be honest, this is an insane (celebrations needed) objective and would need some very significant 'wind in your sails' to ever achieve - of course, anything is possible, so please do drop us a note if you ever hit such amazing returns using the AlgoEdge trading system!

The choice is always yours - change the Profit setting to suit you!

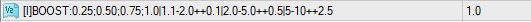

The sixth Important 'platform-generic' Parameter that you must make a decision on, looks like this :

You will find this parameter right towards the beginning of the properties table list - simply look for the [I] Prefix and then the associated text:

BOOST:0.25-1.0++0.25|1.0-2.0++0.1|2.0-5.0++0.5|5-10++2.5

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on your preferred lotsizing for each order that you place in the market. As we will demonstrate to you elsewhere in this user-manual, you are provided with a number of ways to optimise lotsizing, either for a unique symbol or even "muliplier" effects that you are able to apply across Financial categories. (more on that later)

This particular "BOOST" setting is a very simple way to alter all settings across the entire portfolio in one sweep!

The default setting that sits behind the way that lotsizing is computed (your engagement with this is in another section of the user manual) generally targets a positional risk of around 0.25%, although this can vary especially for high cost instruments, ...but, generally let's just say 0.25% for explanatory purposes: Now, when you change this "BOOST" setting, you would impact that lotsizing based on the ratio that you select. If for example, you were to select a ratio here, say '1.5' X, then that lotsizing would be boosted from 0.25% to 0.375% (example only).

Simply select the portfolio-level BOOST_X objective that you think appropriate here and save it to your Master file - the default setting of '1.0' represents 1X multiplier (in other words no change to the underlying lotsizing computation of profit at the portfolio-level).

The value that you select is best understood and handled by the algorithm when you enter such value as guided in the input text script, meaning: If you would like to use a Profit setting in the range of 0.25-1.0 X, then your selected increments should be 0.25, i.e. 0.25/0.50/0.75/1.0; in the range of 1.0-2.0 X, then your selected increments should be 0.1, i.e. 1.0/1.1/1.2/1.3...(up to 2.0); in the range 2.0-5.0 X, your selection should be in intervals of 0.5, i.e. 2.0/2.5/3.0/3.5...(up to 5.0);in the range 5-10 X, your selection should be in intervals of 2.5, i.e. 5/7.5/10). so, we have provided an ability for you to select a BOOST level here on lotsizing, in a very simple way to be applied right across your portfolio, in the range 0.25 X up to 10 X!

That's power in it's simplicity!

The choice is always yours - change the BOOST setting to suit you!

You will find this parameter right towards the beginning of the properties table list - simply look for the [I] Prefix and then the associated text:

BOOST:0.25-1.0++0.25|1.0-2.0++0.1|2.0-5.0++0.5|5-10++2.5

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on your preferred lotsizing for each order that you place in the market. As we will demonstrate to you elsewhere in this user-manual, you are provided with a number of ways to optimise lotsizing, either for a unique symbol or even "muliplier" effects that you are able to apply across Financial categories. (more on that later)

This particular "BOOST" setting is a very simple way to alter all settings across the entire portfolio in one sweep!

The default setting that sits behind the way that lotsizing is computed (your engagement with this is in another section of the user manual) generally targets a positional risk of around 0.25%, although this can vary especially for high cost instruments, ...but, generally let's just say 0.25% for explanatory purposes: Now, when you change this "BOOST" setting, you would impact that lotsizing based on the ratio that you select. If for example, you were to select a ratio here, say '1.5' X, then that lotsizing would be boosted from 0.25% to 0.375% (example only).

Simply select the portfolio-level BOOST_X objective that you think appropriate here and save it to your Master file - the default setting of '1.0' represents 1X multiplier (in other words no change to the underlying lotsizing computation of profit at the portfolio-level).

The value that you select is best understood and handled by the algorithm when you enter such value as guided in the input text script, meaning: If you would like to use a Profit setting in the range of 0.25-1.0 X, then your selected increments should be 0.25, i.e. 0.25/0.50/0.75/1.0; in the range of 1.0-2.0 X, then your selected increments should be 0.1, i.e. 1.0/1.1/1.2/1.3...(up to 2.0); in the range 2.0-5.0 X, your selection should be in intervals of 0.5, i.e. 2.0/2.5/3.0/3.5...(up to 5.0);in the range 5-10 X, your selection should be in intervals of 2.5, i.e. 5/7.5/10). so, we have provided an ability for you to select a BOOST level here on lotsizing, in a very simple way to be applied right across your portfolio, in the range 0.25 X up to 10 X!

That's power in it's simplicity!

The choice is always yours - change the BOOST setting to suit you!

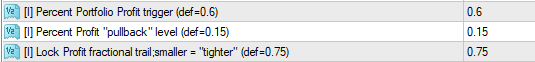

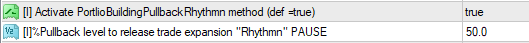

The seventh Important 'platform-generic' Parameter that you must make a decision on, is actually a group of 3 parameters that work together to deliver one of our most powerful tools in the AlgoEdge portfolio-building trading system!

These parameters underscore the inner-workings of our Portfolio-level training stop loss and look like this :

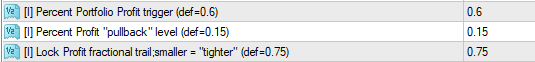

You will find this grouping of 3 parameters towards the end of the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Percent Portfolio Profit trigger (def=0.6)

Percent Profit "pullback" level (def=0.15)

Lock Profit fractional trail;smaller = "tighter" (def=0.75)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on how exactly you would like to trigger and control a portfolio-level trailing LockProfit. This is Intellectual Property (IP) to 99 White Swans that we are very proud of as it gives you (the Trader) an amazingly powerful tool to manage Risk and potentially maximise the Profits on your entire active portfolio (open positions).

Effectively, this 'trailing LockProfit' works in much the same way as you may be familiar with for what you would know as a 'trailing stoploss' on single/independent open positions - what makes the AlgoEdge system approach to this so powerful is that in this instance, whilst each individual trade may still indeed have it's own active trailing stops, YOU are now provided with the ability to apply this logic across all open positions in your portfolio in an entirely synchronised and interdependent way.

Imagine this : you now have the power to build a portfolio that may include both winning and losing positions, yet as long as your portfolio moves into defined levels of profit, you may now 'Lock-In' that profit regardless of the individual positional moves. As a 'trailing LockProfit' you also leave open the opportunity for the Profit to continue to grow, yet it would trigger a 'CloseAll' event if the portfolio profit pulled back to the defined 'trailing' level.

Here's how these LockProfit settings work:

(1) Percent Portfolio Profit trigger: The default setting for this is 0.6% and you may change this however you see fit to best suit your preferred trading style and rhythm. The way that this works is that the LockProfit capability remains completely DORMANT until such time as the portfolio % profit exceeds the level that you have defined here. Once the trigger level of portfolio % profit is exceeded, the LockProfit capability becomes active. There is also a way to check and confirm that the activation has taken place - keep an eye on the commentary text section on your Symbol chart and look out specifically for this line of text :

You will find this grouping of 3 parameters towards the end of the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Percent Portfolio Profit trigger (def=0.6)

Percent Profit "pullback" level (def=0.15)

Lock Profit fractional trail;smaller = "tighter" (def=0.75)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on how exactly you would like to trigger and control a portfolio-level trailing LockProfit. This is Intellectual Property (IP) to 99 White Swans that we are very proud of as it gives you (the Trader) an amazingly powerful tool to manage Risk and potentially maximise the Profits on your entire active portfolio (open positions).

Effectively, this 'trailing LockProfit' works in much the same way as you may be familiar with for what you would know as a 'trailing stoploss' on single/independent open positions - what makes the AlgoEdge system approach to this so powerful is that in this instance, whilst each individual trade may still indeed have it's own active trailing stops, YOU are now provided with the ability to apply this logic across all open positions in your portfolio in an entirely synchronised and interdependent way.

Imagine this : you now have the power to build a portfolio that may include both winning and losing positions, yet as long as your portfolio moves into defined levels of profit, you may now 'Lock-In' that profit regardless of the individual positional moves. As a 'trailing LockProfit' you also leave open the opportunity for the Profit to continue to grow, yet it would trigger a 'CloseAll' event if the portfolio profit pulled back to the defined 'trailing' level.

Here's how these LockProfit settings work:

(1) Percent Portfolio Profit trigger: The default setting for this is 0.6% and you may change this however you see fit to best suit your preferred trading style and rhythm. The way that this works is that the LockProfit capability remains completely DORMANT until such time as the portfolio % profit exceeds the level that you have defined here. Once the trigger level of portfolio % profit is exceeded, the LockProfit capability becomes active. There is also a way to check and confirm that the activation has taken place - keep an eye on the commentary text section on your Symbol chart and look out specifically for this line of text :

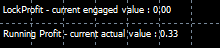

- in the above example, the current portfolio profit is shown to be 0.33% which is of course still below the user-defined trigger level of 0.6% and as such the LockProfit still shows as '0.00' indicating that the LockProfit capability is still DORMANT - the moment that the trigger level is exceeded, this text field will be updated to reflect the activated LockProfit % level.

(2) Percent Profit "pullback" level: The default setting for this is 0.15% and you may change this however you see fit to best suit your preferred trading style and rhythm. The way that this works is that as soon as the LockProfit capability is activated (as explained above), then the AlgoEdge EA also activates a baseline % Profit level at which a 'CloseAll' event would be triggered if breached - in simple terms, the system first triggers the LockProfit capability as outlined in step '1' (above) and then the system will actively monitor and close the entire portfolio in the event that the profit 'pulls back' to the level as defined here in step '2'. Symbols that have a closed market at the time of this CloseAll event would naturally only close when their respective market re-opens.

(3) Lock Profit fractional trail: The default setting for this is 0.75 which represents the fractional trail that gets set against the Portfolio % Profit level. This is where the AlgoEdge IP really differentiates itself - this is hugely powerful capability that you need to understand.

Using the default values provided as a means to explain how this works:

Let's assume that you have a $10,000 Account - at Step '1' = 0.6% = $60 Profit, the EA will activate the 'LockProfit' and it will do so at the 0.15% Profit level = $15; at this exact point, if the market were to 'pull back' and Close the portfolio, then in effect the original Profit potential will have fallen from $60 to $15, which represents a $45 pullback which when presented as a Fraction of the initial $60 profit potential is 45/60 = 0.75. This in fact matches the defaults setting in Step 3, meaning that in the preferred event where the market did in fact not 'pull back' and rather continues to climb higher, then the 0.75 factor described here will be retained, i.e. the baseline LockProfit actual level will continue to climb, effectively 'trailing' the portfolio as the portfolio profit level grows higher.

Choose to manually interface with the trailing LockProfit settings (at any time)

...raising the bar one final level towards Nirvana!

In the above example explanations, we have demonstrated to you how you can set up and save your 'Master Entry' preset file to suit your own preferences; the example that we have shown used 0.6% as a Profit trigger; 0.15% as a baseline LockProfit; and 0.75 as a Fractional trail. Those settings will run and activate every time that you load the 'Master Entry' file to the EA. However, now imagine that you have built up quite a handsome portfolio profit and you are headed towards a major News event - you may be rightfully concerned that with your settings as they are, 75% of your portfolio profits are at risk if the news event sparks market reaction. This scenario may be an example of a situation in which you would perhaps wish to 'very quickly' close up that LockProfit and make it much 'tighter'. To do so is easy : all 3 of the parameters can be changed at any time and importantly you need only make the change on one Symbol Chart to be effected across the whole portfolio.

So, let's now 'draw that picture' by example extrapolation to make sure that you understand how effective this option can be in a heated moment : let's say that heading into that news event, you decide to change the Fraction setting from 0.75 to 0.10 and you then do so on just ONE symbol chart; you should not save this setting, but simply activate it by 'right-clicking' and selecting 'OK' at the bottom of the properties table - you will also see a change to the LockProfit trail in the 'comments text' on the respective Symbol chart. Now, instantly, you have pulled in your LockProfit trail to just 10% behind the total Portfolio Profit achieved!

You may of course select any Fraction that works for you.

...also, in a similar situation, if the 0.6% trigger has not yet been met, you could even change that to a lower number and raise the 0.15% baseline LockProfit level to effectively 'force' adoption of the trailing LockProfit when the situation demands it...again, this is only necessary to be deployed on one Symbol chart EA!

But the magnificence of the AlgoEdge trailing LockProfit does not end there - it gets better still!

- to understand how the trailing LockProfit system actually 'gets even better' than shown here, you will need to jump forward to review the next Important Parameter_8 detailed in this User Manual...

For now, simply select the portfolio-level % Profit Trigger; Pullback Level; and Fractional Trail that you think appropriate here and save it to your Master file.

The choice is always yours - change the LockProfit settings to suit you!

- in the above example, the current portfolio profit is shown to be 0.33% which is of course still below the user-defined trigger level of 0.6% and as such the LockProfit still shows as '0.00' indicating that the LockProfit capability is still DORMANT - the moment that the trigger level is exceeded, this text field will be updated to reflect the activated LockProfit % level.

(2) Percent Profit "pullback" level: The default setting for this is 0.15% and you may change this however you see fit to best suit your preferred trading style and rhythm. The way that this works is that as soon as the LockProfit capability is activated (as explained above), then the AlgoEdge EA also activates a baseline % Profit level at which a 'CloseAll' event would be triggered if breached - in simple terms, the system first triggers the LockProfit capability as outlined in step '1' (above) and then the system will actively monitor and close the entire portfolio in the event that the profit 'pulls back' to the level as defined here in step '2'. Symbols that have a closed market at the time of this CloseAll event would naturally only close when their respective market re-opens.

(3) Lock Profit fractional trail: The default setting for this is 0.75 which represents the fractional trail that gets set against the Portfolio % Profit level. This is where the AlgoEdge IP really differentiates itself - this is hugely powerful capability that you need to understand.

Using the default values provided as a means to explain how this works:

Let's assume that you have a $10,000 Account - at Step '1' = 0.6% = $60 Profit, the EA will activate the 'LockProfit' and it will do so at the 0.15% Profit level = $15; at this exact point, if the market were to 'pull back' and Close the portfolio, then in effect the original Profit potential will have fallen from $60 to $15, which represents a $45 pullback which when presented as a Fraction of the initial $60 profit potential is 45/60 = 0.75. This in fact matches the defaults setting in Step 3, meaning that in the preferred event where the market did in fact not 'pull back' and rather continues to climb higher, then the 0.75 factor described here will be retained, i.e. the baseline LockProfit actual level will continue to climb, effectively 'trailing' the portfolio as the portfolio profit level grows higher.

Choose to manually interface with the trailing LockProfit settings (at any time)

...raising the bar one final level towards Nirvana!

In the above example explanations, we have demonstrated to you how you can set up and save your 'Master Entry' preset file to suit your own preferences; the example that we have shown used 0.6% as a Profit trigger; 0.15% as a baseline LockProfit; and 0.75 as a Fractional trail. Those settings will run and activate every time that you load the 'Master Entry' file to the EA. However, now imagine that you have built up quite a handsome portfolio profit and you are headed towards a major News event - you may be rightfully concerned that with your settings as they are, 75% of your portfolio profits are at risk if the news event sparks market reaction. This scenario may be an example of a situation in which you would perhaps wish to 'very quickly' close up that LockProfit and make it much 'tighter'. To do so is easy : all 3 of the parameters can be changed at any time and importantly you need only make the change on one Symbol Chart to be effected across the whole portfolio.

So, let's now 'draw that picture' by example extrapolation to make sure that you understand how effective this option can be in a heated moment : let's say that heading into that news event, you decide to change the Fraction setting from 0.75 to 0.10 and you then do so on just ONE symbol chart; you should not save this setting, but simply activate it by 'right-clicking' and selecting 'OK' at the bottom of the properties table - you will also see a change to the LockProfit trail in the 'comments text' on the respective Symbol chart. Now, instantly, you have pulled in your LockProfit trail to just 10% behind the total Portfolio Profit achieved!

You may of course select any Fraction that works for you.

...also, in a similar situation, if the 0.6% trigger has not yet been met, you could even change that to a lower number and raise the 0.15% baseline LockProfit level to effectively 'force' adoption of the trailing LockProfit when the situation demands it...again, this is only necessary to be deployed on one Symbol chart EA!

But the magnificence of the AlgoEdge trailing LockProfit does not end there - it gets better still!

- to understand how the trailing LockProfit system actually 'gets even better' than shown here, you will need to jump forward to review the next Important Parameter_8 detailed in this User Manual...

For now, simply select the portfolio-level % Profit Trigger; Pullback Level; and Fractional Trail that you think appropriate here and save it to your Master file.

The choice is always yours - change the LockProfit settings to suit you!

You will find this grouping of 3 parameters towards the end of the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Percent Portfolio Profit trigger (def=0.6)

Percent Profit "pullback" level (def=0.15)

Lock Profit fractional trail;smaller = "tighter" (def=0.75)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on how exactly you would like to trigger and control a portfolio-level trailing LockProfit. This is Intellectual Property (IP) to 99 White Swans that we are very proud of as it gives you (the Trader) an amazingly powerful tool to manage Risk and potentially maximise the Profits on your entire active portfolio (open positions).

Effectively, this 'trailing LockProfit' works in much the same way as you may be familiar with for what you would know as a 'trailing stoploss' on single/independent open positions - what makes the AlgoEdge system approach to this so powerful is that in this instance, whilst each individual trade may still indeed have it's own active trailing stops, YOU are now provided with the ability to apply this logic across all open positions in your portfolio in an entirely synchronised and interdependent way.

Imagine this : you now have the power to build a portfolio that may include both winning and losing positions, yet as long as your portfolio moves into defined levels of profit, you may now 'Lock-In' that profit regardless of the individual positional moves. As a 'trailing LockProfit' you also leave open the opportunity for the Profit to continue to grow, yet it would trigger a 'CloseAll' event if the portfolio profit pulled back to the defined 'trailing' level.

Here's how these LockProfit settings work:

(1) Percent Portfolio Profit trigger: The default setting for this is 0.6% and you may change this however you see fit to best suit your preferred trading style and rhythm. The way that this works is that the LockProfit capability remains completely DORMANT until such time as the portfolio % profit exceeds the level that you have defined here. Once the trigger level of portfolio % profit is exceeded, the LockProfit capability becomes active. There is also a way to check and confirm that the activation has taken place - keep an eye on the commentary text section on your Symbol chart and look out specifically for this line of text :

You will find this grouping of 3 parameters towards the end of the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Percent Portfolio Profit trigger (def=0.6)

Percent Profit "pullback" level (def=0.15)

Lock Profit fractional trail;smaller = "tighter" (def=0.75)

(take note of the icon colour - it can help you find the parameter quicker)

This is an Important selection because your selection here provides guidance to the AlgoEdge EA on how exactly you would like to trigger and control a portfolio-level trailing LockProfit. This is Intellectual Property (IP) to 99 White Swans that we are very proud of as it gives you (the Trader) an amazingly powerful tool to manage Risk and potentially maximise the Profits on your entire active portfolio (open positions).

Effectively, this 'trailing LockProfit' works in much the same way as you may be familiar with for what you would know as a 'trailing stoploss' on single/independent open positions - what makes the AlgoEdge system approach to this so powerful is that in this instance, whilst each individual trade may still indeed have it's own active trailing stops, YOU are now provided with the ability to apply this logic across all open positions in your portfolio in an entirely synchronised and interdependent way.

Imagine this : you now have the power to build a portfolio that may include both winning and losing positions, yet as long as your portfolio moves into defined levels of profit, you may now 'Lock-In' that profit regardless of the individual positional moves. As a 'trailing LockProfit' you also leave open the opportunity for the Profit to continue to grow, yet it would trigger a 'CloseAll' event if the portfolio profit pulled back to the defined 'trailing' level.

Here's how these LockProfit settings work:

(1) Percent Portfolio Profit trigger: The default setting for this is 0.6% and you may change this however you see fit to best suit your preferred trading style and rhythm. The way that this works is that the LockProfit capability remains completely DORMANT until such time as the portfolio % profit exceeds the level that you have defined here. Once the trigger level of portfolio % profit is exceeded, the LockProfit capability becomes active. There is also a way to check and confirm that the activation has taken place - keep an eye on the commentary text section on your Symbol chart and look out specifically for this line of text :

The eighth Important 'platform-generic' Parameter that you must make a decision on, is very closely linked to the previous group of 3 parameters described in Important Parameter_7 : The DYNAMIC capability that we add here further raises the bar on one of our most powerful tools in the AlgoEdge portfolio-building trading system!

This parameter gives you the option to Select/Deselect DYNAMIC capability in the manner of trailing the Portfolio-level LockProfit and looks like this :

You will find this parameter towards the end of the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Dynamic Lock Profit Fraction Trail Multiplier(def=true)

(take note of the icon colour - it can help you find the parameter quicker)

This is an important selection because your selection here will guide the AlgoEdge EA to either Activate or De-Activate the DYNAMIC capability of the portfolio-level Trailing LockProfit, according to your own preference. This is Intellectual Property (IP) to 99 White Swans that we are very proud of as it gives you (the Trader) an even more powerful tool to manage Risk and potentially maximise the Profits on your entire active portfolio (open positions).

Refer to 'Important Parameter_7' (Trailing LockProfit) : You will have already optimised the settings for the portfolio-level Trailing Lock Profit as described in 'Important Parameter_7'. However, the limitation in this capability is that it works with a STATIC application of the Fractional Trail. For example: if you had selected the default level of 0.75 as the Fractional trail, what this effectively means that at any stage, 75% of your hard-earned portfolio profit (open positions) is always at risk - i.e. you will always have a profit locked in, but it may not be maximised. Imagine instead a dynamic scaling of this fractional approach, meaning that the more your portfolio profit grows, so too the "tighter" this fractional Profit Lock becomes!

Here's how this DYNAMIC LockProfit system works:

By default, this DYNAMIC control is already activated with a setting of 'true'. You may change it to 'false' if you prefer the STATIC approach towards the fractional trail of your portfolio-wide LockProfit. Once you activate the 'true' setting the DYNAMIC control is constantly reviewing the Total Portfolio-level % Profit and matches this against a defined table of values (protected 99WS IP). Whilst this IP is protected, what it actually does is rather simple to understand : basically, we start-off with a trailing fractional profit as you have previously defined (default 0.75); then, as the profit passes some key Profit hurdles (1.0/1.5/2/0/2.5%...all the way to 100%) then so the fraction applied to the Trailing Lock Profit is reduced until it is extremely tight and the likelihood of a CloseAll event being triggered is very high. This approach maximises the Profit that you ultimately exit the Portfolio trade with!

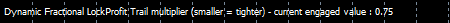

There is also a way to check and confirm that the activation has taken place - keep an eye on the commentary text section on your Symbol chart and look out specifically for this line of text :

You will find this parameter towards the end of the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Dynamic Lock Profit Fraction Trail Multiplier(def=true)

(take note of the icon colour - it can help you find the parameter quicker)

This is an important selection because your selection here will guide the AlgoEdge EA to either Activate or De-Activate the DYNAMIC capability of the portfolio-level Trailing LockProfit, according to your own preference. This is Intellectual Property (IP) to 99 White Swans that we are very proud of as it gives you (the Trader) an even more powerful tool to manage Risk and potentially maximise the Profits on your entire active portfolio (open positions).

Refer to 'Important Parameter_7' (Trailing LockProfit) : You will have already optimised the settings for the portfolio-level Trailing Lock Profit as described in 'Important Parameter_7'. However, the limitation in this capability is that it works with a STATIC application of the Fractional Trail. For example: if you had selected the default level of 0.75 as the Fractional trail, what this effectively means that at any stage, 75% of your hard-earned portfolio profit (open positions) is always at risk - i.e. you will always have a profit locked in, but it may not be maximised. Imagine instead a dynamic scaling of this fractional approach, meaning that the more your portfolio profit grows, so too the "tighter" this fractional Profit Lock becomes!

Here's how this DYNAMIC LockProfit system works:

By default, this DYNAMIC control is already activated with a setting of 'true'. You may change it to 'false' if you prefer the STATIC approach towards the fractional trail of your portfolio-wide LockProfit. Once you activate the 'true' setting the DYNAMIC control is constantly reviewing the Total Portfolio-level % Profit and matches this against a defined table of values (protected 99WS IP). Whilst this IP is protected, what it actually does is rather simple to understand : basically, we start-off with a trailing fractional profit as you have previously defined (default 0.75); then, as the profit passes some key Profit hurdles (1.0/1.5/2/0/2.5%...all the way to 100%) then so the fraction applied to the Trailing Lock Profit is reduced until it is extremely tight and the likelihood of a CloseAll event being triggered is very high. This approach maximises the Profit that you ultimately exit the Portfolio trade with!

There is also a way to check and confirm that the activation has taken place - keep an eye on the commentary text section on your Symbol chart and look out specifically for this line of text :

- in the above example, the current portfolio trailing LockProfit is shown to be 0.75 which is a DYNAMIC number that will change (reduce) as Profit grows.

Simply select 'true' to activate DYNAMIC control of the Fraction applied to the portfolio-level % Profit Trigger; select 'false' to change this to a STATIC fraction, but still keep the trailing LockProfit active; save your settings to your Master file.

The choice is always yours - change the LockProfit settings to suit you!

- in the above example, the current portfolio trailing LockProfit is shown to be 0.75 which is a DYNAMIC number that will change (reduce) as Profit grows.

Simply select 'true' to activate DYNAMIC control of the Fraction applied to the portfolio-level % Profit Trigger; select 'false' to change this to a STATIC fraction, but still keep the trailing LockProfit active; save your settings to your Master file.

The choice is always yours - change the LockProfit settings to suit you!

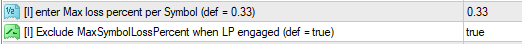

The ninth Important 'platform-generic' Parameter that you must make a decision on, looks like this :

You will find this parameter about 3/4 of the way down the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Max %Risk - single trade,incl 'safe' trades >LP(def=6.0)

(take note of the icon colour - it can help you find the parameter quicker)

This is an important parameter because your selection here will guide the AlgoEdge EA on whether or not to include/exclude an order based on the metric of %Risk associated with that particular (single) trade order. It is important to remind yourself at this point that %Risk is impacted by a number of factors :

Lotsizing;

Stop Loss level;

Leverage;

Instrument/Symbol pricing;

Contract size;

Account Size;

- some of the above factors may overlap in their impact on risk, but most important is that you simply remember that if you misplace your attention to any of these factors, then it is quite easy to end up placing an order that is 'overweight' on %Risk exposure - that is something that you do not wish to do! This is the reason that we have provided the capability here to 'protect' you against such 'misplaced' trade orders.

The default setting on this parameter is 6.0% which is actually (in our opinion) a very high level of Risk and it is most likely that you would want to optimise this to a lower level - the reason that we have chosen to leave the default setting this high is actually to help you in aligning on some of the other related optimisations, like Stop Loss/Take Profit (SL/TP) levels and threshold entry stipulation, all of which will be covered elsewhere in this User-Manual - it does not help you when trying to optimise your settings if an expected order does not execute based on this Risk setting and then your optimisation (principally during the DEMO phase of your setups are delayed, with frustration).

Also, you are reminded that this is only one of a number of Risk Mitigation measures that we do have in place to help limit your Risk in the market. In some instances, %Risk exposure can be very heavily impacted by having TOO SMALL AN ACCOUNT SIZE - do think carefully about this, as it is never a good idea to be excessively exposed to Risk; in such instances, if you are determined to continue trading with a small account size, it is best to allocate the trading of 'more expensive' Symbols to a stage when your portfolio already has an engaged LockProfit in place - that way, your %Risk is mitigated by your profits on open positions - we will show you elsewhere in this User-Manual how you can go about doing this..

Here's how this Max %Risk setting works:

By default, this Max % Risk setting is 6.0% - this is as applied to a single Symbol order entry - in an instance where the computed %Risk for a trade order exceeds the level that is stipulated here, then that order will be ignored and an appropriate error message will be 'printed' to your MT4 'Experts' tab. Choose the Max % Risk setting that suits you and your trading style, but also don't make the setting too constrained, especially not when still in a phase of optimising other correlated factors - once you have completed all of your necessary optimisations (ideally, during the phase when you are still trading with a DEMO account), you can then return here and optimise this setting further, prior to commencing with your LIVE trading.

The choice is always yours - change the Max %Risk settings to suit you!

You will find this parameter about 3/4 of the way down the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

Max %Risk - single trade,incl 'safe' trades >LP(def=6.0)

(take note of the icon colour - it can help you find the parameter quicker)

This is an important parameter because your selection here will guide the AlgoEdge EA on whether or not to include/exclude an order based on the metric of %Risk associated with that particular (single) trade order. It is important to remind yourself at this point that %Risk is impacted by a number of factors :

Lotsizing;

Stop Loss level;

Leverage;

Instrument/Symbol pricing;

Contract size;

Account Size;

- some of the above factors may overlap in their impact on risk, but most important is that you simply remember that if you misplace your attention to any of these factors, then it is quite easy to end up placing an order that is 'overweight' on %Risk exposure - that is something that you do not wish to do! This is the reason that we have provided the capability here to 'protect' you against such 'misplaced' trade orders.

The default setting on this parameter is 6.0% which is actually (in our opinion) a very high level of Risk and it is most likely that you would want to optimise this to a lower level - the reason that we have chosen to leave the default setting this high is actually to help you in aligning on some of the other related optimisations, like Stop Loss/Take Profit (SL/TP) levels and threshold entry stipulation, all of which will be covered elsewhere in this User-Manual - it does not help you when trying to optimise your settings if an expected order does not execute based on this Risk setting and then your optimisation (principally during the DEMO phase of your setups are delayed, with frustration).

Also, you are reminded that this is only one of a number of Risk Mitigation measures that we do have in place to help limit your Risk in the market. In some instances, %Risk exposure can be very heavily impacted by having TOO SMALL AN ACCOUNT SIZE - do think carefully about this, as it is never a good idea to be excessively exposed to Risk; in such instances, if you are determined to continue trading with a small account size, it is best to allocate the trading of 'more expensive' Symbols to a stage when your portfolio already has an engaged LockProfit in place - that way, your %Risk is mitigated by your profits on open positions - we will show you elsewhere in this User-Manual how you can go about doing this..

Here's how this Max %Risk setting works:

By default, this Max % Risk setting is 6.0% - this is as applied to a single Symbol order entry - in an instance where the computed %Risk for a trade order exceeds the level that is stipulated here, then that order will be ignored and an appropriate error message will be 'printed' to your MT4 'Experts' tab. Choose the Max % Risk setting that suits you and your trading style, but also don't make the setting too constrained, especially not when still in a phase of optimising other correlated factors - once you have completed all of your necessary optimisations (ideally, during the phase when you are still trading with a DEMO account), you can then return here and optimise this setting further, prior to commencing with your LIVE trading.

The choice is always yours - change the Max %Risk settings to suit you!

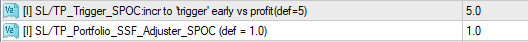

The tenth Important 'platform-generic' Parameter that you must make a decision on, is actually a pair of 2 parameters that target the optimisation of Stop Loss and Take Profit (SL/TP) levels and looks like this :

You will find these parameters 3/4 of the way down the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

SL/TP_Trigger_SPOC:incr to 'trigger' early vs profit(def=5)

SL/TP_Portfolio_SSF_Adjuster_SPOC (def = 1.0)

(take note of the icon colour - it can help you find the parameter quicker)

This is an important selection because your selection here will guide the AlgoEdge EA on your preference for setting SL/TP levels and further triggering when you would like to activate trailing. This is Intellectual Property (IP) to 99 White Swans that we are very proud of as it gives you (the Trader) another powerful tool to manage Risk and potentially maximise your Profits - in this case, directed at multiple* Symbols and their associated SL/TP activation, whilst at the same time 'respecting' separate controls (covered elsewhere in this User-Manual) that target the 'fine-tuning' of individual symbols.

*Note: The SL/TP focus here is on 'multiple' Symbols through a system design that focuses on the principle of Single Point Of Control (SPOC), meaning that it is OK to use one value right across all Symbols, but the opportunity is still there to be individualistic in application to individual Symbols, where that is the Trader's desire.

You simply won't find anything elsewhere on the market that provides you with this level of control and interaction, as provided by the AlgoEdge trading system and most certainly nothing that can handle as many diverse Symbols as our AlgoEdge system does, always in an entirely synchronised manner!

Here's how this SL/TP system works:

Before explaining the default SL/TP settings and how you may then choose to optimise them, we need you to understand that the dynamic setting of SL/TP levels on such a diverse range of Symbols is no small feat - all of the below are examples of factors that have a bearing on this:

Financial Category;

Price;

Leverage;

Decimal positioning - impacting points, pips and handles;

Spread;

Broker rules - minimum lotsizing; pricepoints ;stoplevels;

All of the above, make this SL/TP approach that we are able to bring to you in the AlgoEdge Trading system once again 99 White Swans Intellectual Property (IP) that we are very proud of!

We have managed to devise a system that 'hides' extremely complex algorithmn computations and presents them to you instead as two very simple default values : (1) SL/TP Trigger value of 5.0; (2) SL/TP SSF Portfolio Adjuster value of 1.0;

Here is an explanation of how you may now interact with and optimise these 2 values to suit your own trading preferences:

(1)SL/TP Trigger value :

We have set a default value here of 5.0 - the value of '5.0' has no specific merit, but is simply provided as a reference tool against which you can optimise the setting to impact the SL/TP Trigger value : '5.0' is actually a 'masked' value that sits in front of a hugely diversified metric that is associated with each Symbol and is representative of a Profit/Loss value that will trigger the SL/TP into a dynamic action which may be to either trail the stoploss, or in some situations to adapt the TP as a risk mitigation tool to potentially reduce losses in a losing trade situation - if, over time, you find the '5.0' value to be a bit 'loose' on triggering this SL/TP action, you may simply increase the number - so, for example if you were to increase the value of '5.0' by 50% to '7.5', then this would proportionally reduce the Profit/Loss level at which the SL/TP dynamics come into play; similarly, a reduction of the value of '5.0' to a lower number, would have a reverse effect (in proportion).

(2)SL/TP SSF Portfolio Adjuster value :

We have set a default value here of 1.0 - the value of '1.0' has no specific merit, but is simply provided as a reference tool against which you can optimise the setting to impact the SL/TP SSF value : '1.0' is actually a 'masked' value that sits in front of a hugely diversified metric that is associated with each Symbol and is representative of the Symbol Specific Factor (SSF) value that impacts the initial SL/TP that is set when the order is placed into the market - this precedes the dynamic action that describes the later Profit/Loss trailing of SL/TP, as described above

- if, over time, you find the '1.0' value to be placing SL/TP levels that exceed your expectation or preference, you can try proportionally reducing this value to better suit your preference; similarly, the reverse approach can be used to increase SL/TP levels.

Always remember that SL/TP settings will also impact %Risk exposure, as detailed elsewhere in this User-Manual.

- if this all sounds a little bit too complex, it is because IT IS complex! But all that you really need to know is that the default value of '5.0' will work for you in most situations, but if you want you can make the SL/TP even more dynamic by slightly increasing the value, or you can 'soften' the SL/TP action by reducing the value somewhat. Also, it is useful to know that this is also not the only way that AlgoEdge Trading system handles stop loss and take profit levels - we also have some other overlying techniques that monitor and track very unique SL/TP approaches to be explained elsewhere in this User-Manual.

Simply input the SL/TP 'Trigger' and 'SSF" values that you feel to be most appropriate to suit your trading style and expectations.

- feel free to 'revisit' and further optimise these input levels as you gain experience with how the AlgoEdge Trading system behaves over time...

The choice is always yours - change the SL/TP settings to suit you!

You will find these parameters 3/4 of the way down the properties table list - simply scroll down and look for the [I] Prefix and then the associated text:

SL/TP_Trigger_SPOC:incr to 'trigger' early vs profit(def=5)

SL/TP_Portfolio_SSF_Adjuster_SPOC (def = 1.0)

(take note of the icon colour - it can help you find the parameter quicker)

This is an important selection because your selection here will guide the AlgoEdge EA on your preference for setting SL/TP levels and further triggering when you would like to activate trailing. This is Intellectual Property (IP) to 99 White Swans that we are very proud of as it gives you (the Trader) another powerful tool to manage Risk and potentially maximise your Profits - in this case, directed at multiple* Symbols and their associated SL/TP activation, whilst at the same time 'respecting' separate controls (covered elsewhere in this User-Manual) that target the 'fine-tuning' of individual symbols.

*Note: The SL/TP focus here is on 'multiple' Symbols through a system design that focuses on the principle of Single Point Of Control (SPOC), meaning that it is OK to use one value right across all Symbols, but the opportunity is still there to be individualistic in application to individual Symbols, where that is the Trader's desire.

You simply won't find anything elsewhere on the market that provides you with this level of control and interaction, as provided by the AlgoEdge trading system and most certainly nothing that can handle as many diverse Symbols as our AlgoEdge system does, always in an entirely synchronised manner!